USD/JPY declines as Yen strengthens on BoJ hike bets and weak US jobs data

USD/JPY declines as Yen strengthens on BoJ hike bets and weak US jobs data

USD/JPY declines as Yen strengthens on BoJ hike bets and weak US jobs data

Westpac Sees Gold Building a Firm Base, Targets $4,300–$4,500 in 2026 Gold is consolidating just above $4,300 per ounce, with spot prices last seen at $4,305, little changed on the day after a strong run through November and early December. Westpac argues that the pullback from October's highs near $4,400 reflects calmer near-term.

Platinum markets test multi-year highs as rally continues.

The American currency remains under pressure as traders focus on the situation in the job market.

Pound Sterling Price News and Forecast: GBP/USD erupts as soft US jobs data crush the Dollar

Over the past five trading sessions, USD/CAD has posted a decline of more than 0.7% in favor of the Canadian dollar, maintaining a consistent bearish bias in the short term. For now, selling pressure has remained strong, especially after the release of U.S. employment data, which reinforced a structural weakness in the U.S. dollar.

The Pound US Dollar (GBP/USD) exchange rate surged to a two-month high on Tuesday as better-than-expected UK data supported Sterling. Latest — Exchange Rates:Pound to Dollar (GBP/USD): 1.34165 (+0.28%)Euro to Dollar (EUR/USD): 1.17757 (+0.19%)Dollar to Japanese Yen (USD/JPY): 154.6005 (-0.28%) DAILY RECAP: The Pound (GBP) advanced.

Pound Sterling Price News and Forecast: GBP/USD erupts as soft US jobs data crush the Dollar

This is one of those beautiful moments when two markets tell one coherent story, and both point in the same direction.

GBP/USD erupts as soft US jobs data crush the Dollar

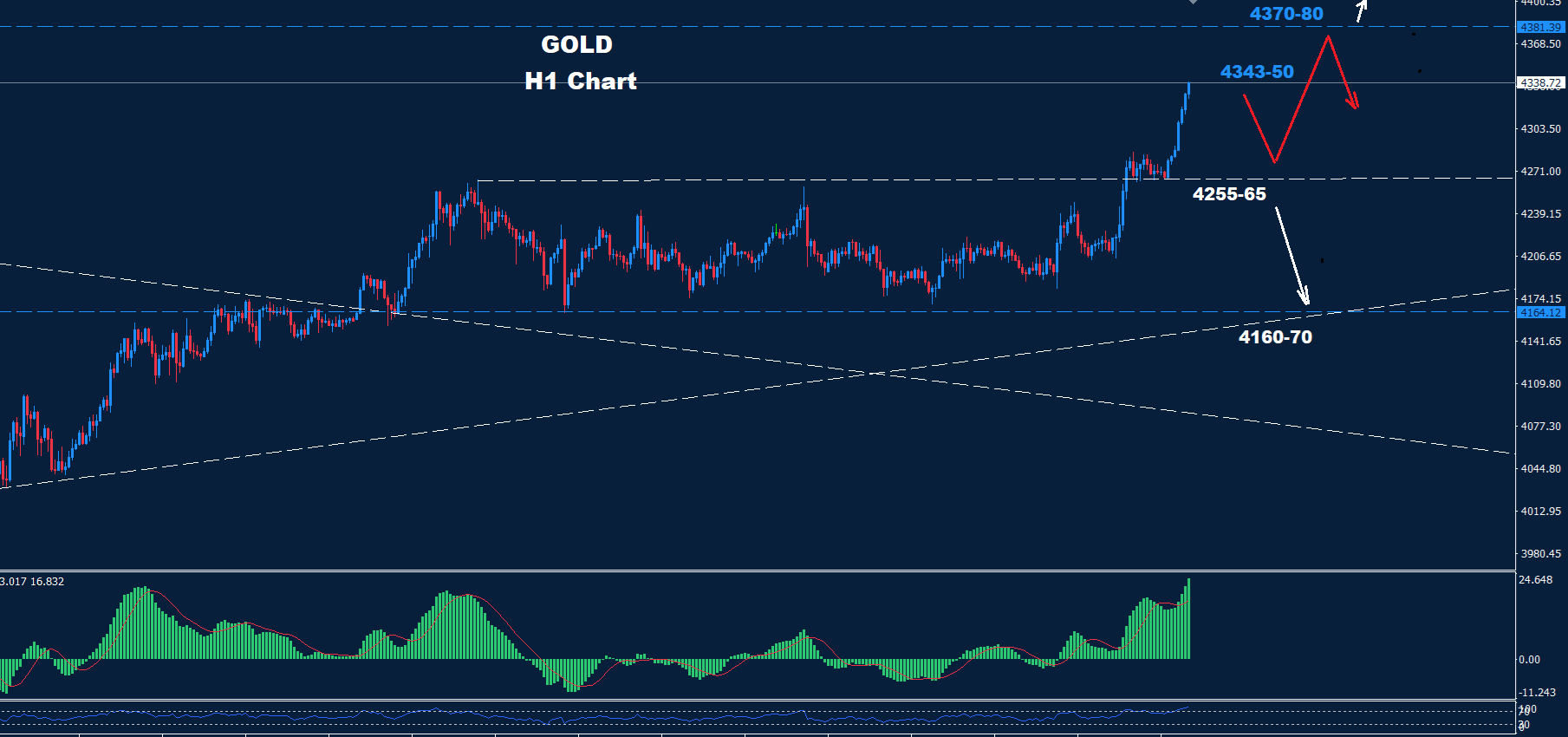

Gold remains choppy near the top of a long-standing channel, with repeated signs of short-term exhaustion suggesting a possible pullback. Despite near-term volatility, the broader uptrend remains intact as traders watch key central bank decisions.

EUR/USD climbs to three-month high after delayed US jobs and Retail Sales data

The Euro to Dollar (EUR/USD) exchange rate has secured net gains this month and is trading just above 1.1750, close to 11-week highs. Nordea forecasts that EUR/USD will strengthen to 1.24 by the end of 2026 amid a stronger global economy and fears over Fed policy.

Silver remains choppy as it consolidates below a major psychological barrier, with price action suggesting sideways movement after a strong run. Volatility persists, but longer-term pressure still favors an eventual push higher.

The US dollar remains under pressure as major currency pairs approach key technical levels, with the euro, British pound, and euro–pound cross all testing important resistance, support, and trend-defining areas amid central bank uncertainty.

The US dollar was already down on the day when the US jobs report was released. It then fell further as traders reacted to the rise in the unemployment rate to its highest level since 2021, even if the headline jobs growth beat expectations slightly.

Silver slips but stays near record highs as traders weigh U.S. jobs data and key levels at $64.67 and $60.53 in a pivotal silver market outlook.

The Indian rupee is down by more than 2% in the last month and there's strong evidence USD/INR pair could soon break past the recent 91.08 ATH.

Gold price eases as XAUUSD traders wait on U.S. jobs data, with resistance at $4353.56 and buy-the-dip support holding near the 50-day MA.

Silver Miners ETF (SIL) surges to all-time high on impulsive breakout

EUR/GBP weakens after UK jobs data and softer Eurozone PMI

Russia's largest Palladium producer sees platinum deficit this year – Commerzbank

Platinum hits $1,800, highest since 2011 – Commerzbank

Gold retreats below $4,300 ahead of US jobs data – Commerzbank

EUR/USD near highest level since early October – BBH

Gold under pressure as traders brace for delayed US NFP release

The pound is rising as investors digest the latest jobs data combined with PMI figures. The UK unemployment rate rose to 5.1%, up from 5%, marking the highest level since January 2021.

Gold Price Forecast: XAU/USD slumps to near $4,270, US NFP takes centre stage

USD/JPY dips ahead of expected BOJ hike – OCBC

In this technical blog, we will look at the past performance of the Daily Elliott Wave Charts of GBPUSD. In which, the rally from 13 January 2025 low is unfolded as impulse sequence & showed a higher high sequence therefore, called for an extension higher to take place.

USD/CNH approaches 7.00 despite weak Chinese data – ING

Today the EUR/NZD rate touched the 2.4000 level — the highest reading since late November — but then saw a fairly sharp pullback. Fundamentally, the heightened volatility is driven by a combination of factors.

Silver price today: Silver falls, according to FXStreet data

USD/CNH breaks lower as downtrend accelerates – Société Générale

USD/CNH stays heavy despite weak China data – OCBC

EUR/USD holds gains ahead of Eurozone business activity figures

DXY remains under pressure near 98.30 as markets price slower US growth, weaker NFP, and cautious Fed policy, lifting GBP/USD and EUR/USD trends.

Gold dropped as prices trade inside the trading zone between support 4255-65 and resistance 4350-65. Below 4255 more of a drop could hit the market with supports at 4205 and 4160-70.

GBP/JPY rebounds from over one-week low, back above 207.00 after UK jobs data

EUR/GBP trims gains below 0.8800 after UK labor market report

USDJPY met the target of 154.90 and managed to hit a few pips below it. As we see over the chart, as long as the market remains above 154.45, another rebound toward 156.15 and higher could hit the market.

GBPUSD managed to break above the resistance of 1.3360-70 which could push for a further advance. As we see over the Intraday chart, prices face a support zone around 1.3280-99 which could cause a move towards targets 1.3470 and 1.3600.

Prices advanced above the downtrend line as we see from the previous chart which could push for further advance. The support trend is still around 1.1590, where as long as prices hold above it, the advance could continue toward 1.1820.

AUD/USD Price Forecast: Recovers a few pips from 0.6620-0.6615 resistance-turned-support

USD/CHF trades calmly near 0.7960 in countdown to US NFP

Pound Sterling Price News and Forecast: GBP/USD trades in red ahead of the UK labor market data

The cycle in Silver (XAGUSD) from the October 28, 2025 low remains in progress as a clear five‑wave impulse Elliott Wave sequence. From that low, wave 1 advanced to $49.36 before a corrective decline in wave 2 concluded at $46.88.

The 4-hour chart of XAU/USD indicates that the price cleared a key contracting triangle with resistance at $4,230 to enter a positive zone. The bulls even pumped the price above $4,320.

USD/INR continues bull run despite improved India's trade deficit position

The Non-Farm Payrolls (NFP) report, which comes out on December 16, 2025, is the first full look at the US job market since September, and it will be a crucial factor in determining the Federal Reserve's (Fed) strategy for interest rates throughout 2026.

Saudi Arabia Gold price today: Gold falls, according to FXStreet data

Philippines Gold price today: Gold falls, according to FXStreet data

United Arab Emirates Gold price today: Gold falls, according to FXStreet data

When is the UK labor market report and how could it affect GBP/USD?

Pakistan Gold price today: Gold falls, according to FXStreet data

India Gold price today: Gold falls, according to FXStreet data

Malaysia Gold price today: Gold falls, according to FXStreet data

When are the German/ Eurozone flash HCOB PMIs and how could they affect EUR/USD?

Silver Price Forecast: XAG/USD breaks below 100-hour SMA pivotal support near $62.50

USD/CAD flattens around 1.3770 ahead of delayed US NFP data

GBP/USD remains confined in a range above mid-1.3300s ahead of UK jobs report

NZD/USD weakens below 0.5800 on disappointing Chinese data, US NFP data in focus

PBOC sets USD/CNY reference rate at 7.0602 vs. 7.0656 previous

AUD/USD remains depressed below mid-0.6600s; downside seems limited ahead of US NFP report

Gold Price Forecast: XAU/USD holds gains above $4,300 on prospect of further Fed rate cuts

USD/JPY weakens to near 155.00 amid BoJ rate hike bets, US data awaited

EUR/USD supported above 1.1700 as weaker Dollar sets tone before NFP

Silver held near Monday's $64.17 high with buyers in control, consolidating tightly after the channel breakout while the rising 10-day average approaches the former top line—setting up a potential new record close above $63.57 and push toward $65.61 resistance.

Gold prices have put in a strong bounce from the $4,285 level as buyers vie to hold the metal above $4300 into a heavy batch of event risk. If we do see strength in the labor market or higher-than-expected inflation data, there could be an opening door for a pullback in gold.

The Pound to Euro (GBP/EUR) exchange rate got off to a slow start this week as markets brace for a series of high-impact economic releases in the coming days. Latest — Exchange Rates:Pound to Euro (GBP/EUR): 1.13796 (-0.08%)Pound to Dollar (GBP/USD): 1.33759 (+0.06%)Euro to Dollar (EUR/USD): 1.17543 (+0.15%) DAILY RECAP: The Pound.

The Pound Canadian Dollar (GBP/CAD) exchange rate ticked higher on Monday as markets digested Canada's weaker-than-forecast inflation figures. Latest — Exchange Rates:Pound to Canadian Dollar (GBP/CAD): 1.84225 (+0.09%)Euro to Canadian Dollar (EUR/CAD): 1.61891 (+0.18%)Dollar to Canadian Dollar (USD/CAD): 1.37729 (+0.03%) DAILY.

USD/JPY Price Forecast: Pair stalls below 156.00 as momentum fades

The Pound US Dollar (GBP/USD) exchange rate firmed on Monday morning as an improving market mood supported the pairing. Latest — Exchange Rates:Pound to Dollar (GBP/USD): 1.33759 (+0.06%)Euro to Dollar (EUR/USD): 1.17543 (+0.15%)Dollar to Japanese Yen (USD/JPY): 155.304 (-0.36%) DAILY RECAP: The US Dollar (USD) stumbled at the.

Gold holds steady as traders weigh Fed stance and upcoming data

AUD/USD trades lower as US Dollar firms ahead of delayed US NFP data

Bitcoin might be the canary in the gold mine – a declining anti-USD asset, could be the sign that the real USD is about to move higher, which would also affect the precious metals sector.

The GBP/USD is among the major currency pairs to watch owing to the remaining central bank rate decisions and key US data, all due this week. As well as US non-farm payrolls report, we will have key central bank rate decisions to look forward to, including from the UK.

Bulls hold grip and probe again through cracked Fibo barrier at 1.1746 (61.8% of 1.1918/1.1468), also being on track for the third consecutive daily close above broken top of thick daily Ichimoku cloud (1.1693).

Pound Sterling Price News and Forecast: GBP/USD nears 1.3400 as traders brace for BoE cut

The American currency is losing ground as traders focus on falling Treasury yields.

The Pound to Australian dollar (GBP/AUD) exchange rate is trading around 2.0130 after finding support close to 2.000 last week with both currencies securing a firm underlying tone in global markets. MUFG forecasts that GBP/AUD will decline to 1.93 amid a stronger Australian dollar and a shift in yield spreads against the Pound.

The Pound to Euro (GBP/EUR) exchange rate is trading around 1.1400. Rabobank forecasts a gradual grind lower to 1.1240 on a 6-month view as yields move against the UK currency.

EUR/USD trades near multi-week highs amid softer US Dollar, cautious Fed outlook

The EUR/USD pair has accumulated a streak of four consecutive bullish sessions, holding a gain above 1%, which shows that, for now, buying pressure has returned to the pair ahead of the year-end. This renewed upside momentum observed in recent sessions has been supported by the weakness of the U.S. dollar following last week's central bank comments and by expectations of a neutral stance from the European Central Bank in this week's decision.

GBP/USD nears 1.3400 as traders brace for BoE cut

Gold is pushing right back into the zone where optimism and exhaustion tend to collide.

USD/CAD holds firm after Canada CPI misses forecasts

JPY rises sharply on Tankan Survey, USD/JPY hits 155 – Scotiabank

USD/CNH drops below 7.0500, lowest since October 2024 – BBH

USD/CAD remains heavy near 1.3765 – BBH

CAD holds steady near Friday's close against USD – Scotiabank

USD/JPY holds near 155 amid strong Tankan survey – BBH

EUR/JPY weakens as markets price near-certain BoJ rate hike

The US dollar shows early softness as the euro and pound attempt rebounds amid uncertainty over Federal Reserve and Bank of England rate cuts, leaving major currency pairs range-bound while traders wait for clearer central bank direction.

Silver surges as buyers test $64.67, fueled by strong industrial demand and softer yields. Traders watch NFP and CPI for the next move in the silver market.

Gold extends a strong multi-month uptrend, approaching a potential breakout above $4,400, with pullbacks viewed as buying opportunities while key support levels near $4,200 and $3,950 continue to define a bullish structure.

Silver extends a powerful rally toward $65, driven by extreme momentum, heavy volume, and strong demand narratives. While dips remain buying opportunities near $60, volatility risk is elevated and disciplined money management remains essential.

After rising for four consecutive weeks, gold kicked off the new week on a strong footing this morning, rising a cool 0.9%, while silver rebounded from Friday's drop with a 3% bounce. Both metal remained below their respective record highs, with traders being wary of the recent bond market sell-off.

Gold trades firmly below all-time high on Fed, Geopolitical risks

EUR/USD holds gains ahead of busy week – ING