Why is XRP price up today? Key drivers explained

XRP's upward momentum is potentially driven by mass accumulation, aggressive buying pressure, and a shift in market sentiment.

XRP's upward momentum is potentially driven by mass accumulation, aggressive buying pressure, and a shift in market sentiment.

US President Donald Trump recently stated that cryptocurrencies could be used to alleviate the ballooning US national debt, which has recently exceeded $38 trillion. Trump's statement has triggered a global conversation about the role of digital assets, especially Bitcoin (BTC), in addressing the US's debt crisis.

According to software engineer Vincent Van Code, fresh practical reasons are emerging for renewed confidence in XRP among some developers and investors. He argues that the biggest barrier to big firms holding XRP directly isn't price or interest — it's operations and compliance.

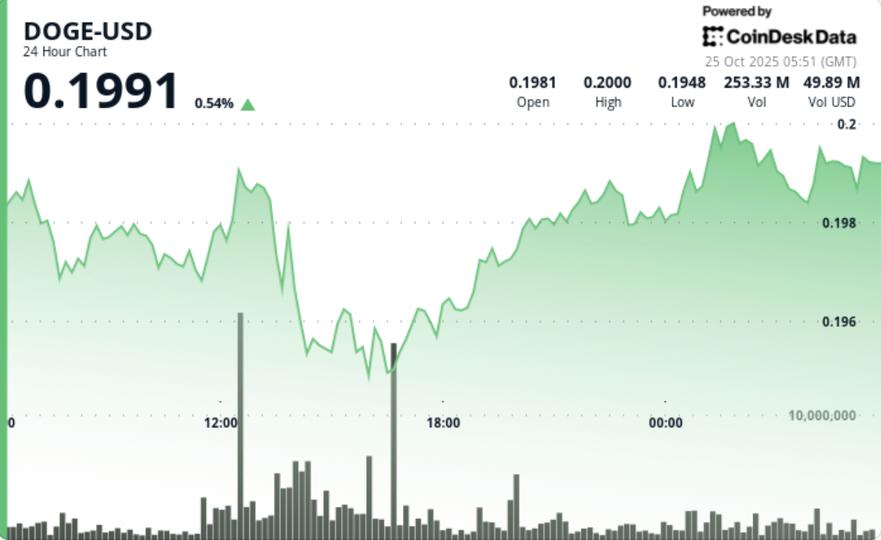

DOGE pushes through critical resistance levels in a 1.8% advance as trading activity surges 170% above average, confirming accumulation patterns near the psychological $0.20 zone.

2025 is turning into a defining year for XRP, as institutional interest in the token reaches new heights. From major ETF inflows to fresh derivatives listings, XRP is finally gaining the kind of attention once reserved for Bitcoin and Ethereum. Two major developments, the first U.S.

XRP is the top performer from the larger-cap alts today.

Ripple's recent wave of high-profile acquisitions signals growing strength and ambition in bridging traditional finance with crypto.

A Ripple co-founder quietly sold $764 million worth of XRP over seven years. The operation, although legal and transparent, reignites tensions within the community.

ASTER has announced a token buyback program in a bid to stabilize token prices and circulating supply. In light of this development, an expert has projected that the token could rise to $10.

Stock exchanges across the Asia-Pacific region are tightening regulations on corporate cryptocurrency holdings due to concerns about market volatility. As more organizations consider digital assets, especially Bitcoin, as part of their treasury strategies, countries like India, Hong Kong, and Australia are implementing stricter measures.

Bitcoin (BTC) recently surged past the $110,000 mark, supported by growing institutional backing and the launch of spot Bitcoin ETFs. This comes in after a week of volatility that has seen BTC go below support levels.

Why are miners quietly returning to Xinjiang after the 2021 crackdown?

Cardano (ADA) appears to be preparing for a major rally, as bullish technical signals and network milestones spark renewed optimism among traders. Related Reading: HYPE Soars Beyond $40 Following Robinhood Listing: What's Next For Hyperliquid's Price?

XRP is green on the weekly, sure, but let's not act like this candle is rewriting the price narrative — it is more like a tiny fish splashing around in a giant tank of red water.

Ripple has completed its acquisition of Hidden Road, a move that will expand its fintech services for institutional clients and boost the utility and reach of its RLUSD stablecoin.

ASTER rebounds with a 12% surge as the rising open interest and bullish funding rates hint at a further bullish run.

Zcash's sudden resurgence is not just another rotation, argues Helius CEO Mert Mumtaz; it is a re-centering of crypto on first principles of cryptography and user choice. In a wide-ranging conversation on Messari's “Fully Diluted” (Oct.

With hardly any discernible movement in price action or on-chain, the Shiba Inu market has entered a period of stagnation. Although SHIB has stabilized following a sharp decline, it still seems to be stuck in a stalemate, with neither bulls nor bears willing to take charge.

"Realistically, expect sideways trading or modest gains to $0.30 - $0.40 if catalysts align, or dips to $0.15 - $0.18 on continued selling," Grok stated.

Crypto markets have entered a holding pattern this week, with Bitcoin and Ethereum maintaining stability as traders prepare for a key U.S. inflation report. The focus is on the upcoming Consumer Price Index (CPI) data, which is expected to impact broader market sentiment and potential policy shifts.

The financial world is witnessing an unprecedented shift, as Ethereum solidifies its position as the sole asset capable of becoming a multi-trillion-dollar institutional store of value. ETH is the only one currently demonstrating the scale, utility, and institutional acceptance to command and securely hold multi-trillion-dollar allocations, fundamentally redefining the future of global wealth preservation and growth.

XRP jumps after Ripple Prime launch, but ETF delays and U.S. shutdown weigh on sentiment. Bulls eye $3 if demand catalysts align.

Tesla has once again capitalized on its Bitcoin holdings, booking a substantial $80 million profit in the third quarter of 2025. While the electric vehicle giant made no changes to its Bitcoin position, the rise in Bitcoin's value over the last three months helped the company report a notable gain.

A sweeping wave of support from corporate giants now includes major crypto players such as Coinbase, Ripple, and others, signaling digital assets' deepening integration into Washington's power circles through the ambitious White House expansion initiative. Crypto Firms Join Corporate Titans in White House Expansion Funding A surge in crypto industry involvement in U.S.

Zcash, BNB, and Virtuals Protocol dominate current crypto momentum with clear breakout signals.

Reports have disclosed a 400% rise in stablecoin transfers on Ethereum over the last 30 days, pushing total transfer volume to $581 billion and more than 12.5 million transfers, according to Token Terminal. Related Reading: 16,000 Ancient Bitcoins Just Moved—And It's Costing Whales Billions The stablecoin market cap on Ethereum now tops $163 billion.

According to recent estimates, China accounted for about 14% of Bitcoin's global hash-rate in late 2025, a slight rise from roughly 13% the prior quarter. Based on reports, that share translates to an estimated slice near 145 EH/s of computing power tied to Chinese influence.

Rumble, a video platform similar to YouTube, is collaborating with Tether to enable creators to receive Bitcoin tips. The company announced the move at the Plan B Forum in Lugano, stating that it aims to help creators earn and remain independent with crypto.

The prospect of XRP ETFs has generated considerable excitement in the crypto market. Despite delays caused by the ongoing U.S. government shutdown, many analysts are optimistic that the U.S. Securities and Exchange Commission (SEC) will approve several XRP spot ETF filings once the shutdown is resolved.

China Poly Group denies Hong Kong stablecoin involvement.

Global finance is undergoing a seismic shift as JPMorgan reportedly gears up to allow institutional clients to use bitcoin and ether as loan collateral, a groundbreaking move that positions digital assets at the heart of mainstream banking and investment strategies.

Bitcoin is struggling to establish a clear bullish structure in the short term, as selling pressure continues to dominate since the October 10 market crash. The asset remains caught in a volatile range, with traders unsure whether the next major move will mark the start of a recovery or the continuation of a broader correction.

Ethereum is struggling to push above the $4,000 level, as market sentiment remains uncertain and volatility keeps investors cautious. Despite several attempts, bulls have failed to sustain momentum, suggesting hesitation at key resistance levels.

Sygnum Bank has partnered with crypto lender Debifi to launch a loan platform that will let borrowers keep partial control of their BTC during the loan term, according to a press release from Friday.

Ripple has officially completed its $1.25 billion acquisition of Hidden Road, marking a major milestone as it becomes the first cryptocurrency company to own a global multi-asset prime broker. Following the acquisition, Hidden Road will rebrand and operate as Ripple Prime, integrating Ripples blockchain technology and digital asset ecosystem into its prime brokerage services.

Pump.fun, the popular meme coin launchpad, has acquired Padre, an advanced multichain trading terminal, as part of its effort to attract more professional retail traders and strengthen its market presence. The company stated that the acquisition would help it tokenize the worlds highest-potential opportunities, leveraging Padres infrastructure to enhance trading activity and broaden its reach in the crypto ecosystem.

Tether launches USAT stablecoin via Anchorage Digital, investing in Rumble.

Ethereum (ETH) is showing renewed strength after a volatile period, edging closer to the crucial $4,000 resistance level. The cryptocurrency has gained traction alongside the broader market rebound, stabilizing above $3,900.

XRP is standing at a crucial technical juncture, hovering near the lower boundary of a descending triangle pattern that could determine its next major price direction. After testing the $2.30 zone earlier this week, the token has recovered slightly to around $2.46.

A significant sell-off by a Chainlink (LINK) whale has sent shockwaves through the cryptocurrency market. A single whale dumped 1.62 million LINK, worth approximately $28.9 million, increasing selling pressure on the market.

Ripple has completed its purchase of global prime broker Hidden Road and rebranded the business as Ripple Prime, a bundled trading, financing and clearing desk for institutions, the company announced Friday.

Tether, the company behind the worlds largest stablecoin USDT, is gearing up to launch a new U.S.-focused digital dollar token called USAT this December. According to CEO Paolo Ardoino, the initiative aims to reach 100 million American users by complying with the GENIUS Act regulations and leveraging partnerships that bridge traditional finance and the crypto economy.

Prediction market platform Polymarket is preparing to launch its own token and airdrop after making a long-anticipated return to the U.S. market. According to Chief Marketing Officer Matthew Modabber, the companys immediate focus is re-establishing its U.S. presence through a fully regulated exchange before introducing the token.

Video sharing platform Rumble has teamed up with Tether to help it add Bitcoin tips to content creators, expected to launch in early to mid-December.

The crypto market is gearing up for heightened volatility once the weekend wraps up, with XRP, Shiba Inu and Ethereum all positioned for major moves. XRP appears ready to face one of its toughest market battles yet, while SHIB edges closer to the $0.00002 mark.

Pump.fun surged 10% in 24 hours, largely driven by newfound demand from whales.

On October 24, a prominent analyst with the pseudonym EGRAG CRYPTO outlined a bold prediction for Bitcoin, suggesting that the cryptocurrency could reach a price as high as $300,000. This prediction comes amidst concerns of a potential downturn in Bitcoin's market performance.

Dogecoin is once again under pressure as bears tighten their hold, keeping the price pinned below key resistance levels. Despite the ongoing consolidation, one crucial support zone is beginning to show signs of strength, hinting that a potential reversal could be on the horizon if buyers step in at the right moment.

Crypto analyst CrediBULL Crypto has shared a confident view of Bitcoin's current market setup, describing the ability to read high-timeframe (HTF) structures as a superpower. His comments came at a time when Bitcoin had experienced notable volatility, fluctuating between $106,000 and $111,000 in recent days.

Grayscale's NYSE bell ringing marked a breakthrough moment for crypto investing as its multi-asset ETF opened institutional access to bitcoin, ether, and XRP, driving wider adoption and expanding exposure across the rapidly maturing digital economy.

Binance, one of the largest cryptocurrency exchanges, has experienced a significant surge in liquidity, with over $1.8 billion worth of USD Coin (USDC) flooding the platform in just three days. This massive influx is raising questions among traders and market analysts alike: is the stage being set for a major market move?

On October 24, 2025, the US Bureau of Labor Statistics released the Consumer Price Index (CPI) numbers for September, revealing a 3% year-over-year increase. This figure came in below the anticipated 3.1%, sparking a significant reaction in financial markets.

Bitcoin (BTC) has been struggling to regain its upward momentum since it hit a high of $116,000 earlier this year, following a recent market crash. As of October 23, 2025, Bitcoin was trading at approximately $107,716, reflecting a 4.08% decline over the past week.

On-chain data shows a Bitcoin whale with a 4,000 BTC balance has woken up after a 14.3 years long slumber to spend 150 tokens. Ancient Bitcoin Whale Has Broken A 14.

XRP's price has been showing signs of consolidation in recent days and oscillating between $2.30 and $2.50. The entire crypto market has been relatively steady, and XRP has managed to maintain its footing above $2.20.

On-chain data shows large wallets shifting into accumulation mode, while chart analysts point to a classic Wyckoff re-accumulation structure.

Early October's (“Uptober”) buy signals in crypto markets proved fleeting. Within mere days, prices tumbled sharply following President Trump's announcement of a 100% tariff on Chinese imports, sparking a broad shift toward risk aversion ahead of the Federal Reserve's upcoming FOMC meeting.

Elon Musk's space exploration firm, SpaceX, moved $133 million worth of Bitcoin on Friday after transferring funds earlier this week.

Copilot AI Predicts new highs for Solana, XRP, and BNB this quarter. Markets have absorbed a tariff shock, awaited the next FOMC signal, and tracked ETF prospects, while technicals have shown consolidations and breakouts across major tokens.

Ripple strengthens its presence in global finance with a $1.25B acquisition of Hidden Road, now rebranded as Ripple Prime.

Shares of leading Bitcoin mining companies rose after Jane Street disclosed new holdings on Thursday, extending a months-long rally across publicly traded mining stocks.

SpaceX, the advanced rockets and spacecraft company, has moved another batch of Bitcoin worth around $133.68 million.

A new survey reveals that many young Australians regret not investing in Bitcoin (BTC) and other cryptocurrencies a decade ago, highlighting the growing influence of digital assets on financial decisions. According to research by crypto broker Swyftx and conducted by YouGov, over 40% of Gen Z and Millennials in Australia now view missing early crypto investments as one of their biggest financial mistakes.

Sui Network's TVL has reached an all-time high of $885.59 million, indicating strong trust and confidence among users.

Rumble partners with Tether to launch Bitcoin tipping, enhancing creator payments and expanding crypto features for users.

Bitcoin sellers put a cap on $112,000, but technical, onchain data and the end of October US macroeconomic calendar suggest that the price compression will trigger a violent expansion.

Ethereum trades near $4K as analysts watch for a breakout from resistance. A move above $4,100 may trigger a relief rally.

Galaxy Digital CEO Mike Novogratz tempered expectations for Bitcoin (BTC) reaching $250,000 by the end of 2025, suggesting that such a surge would require extraordinary market conditions. While some crypto executives remain bullish on BTC's year-end prospects, Novogratz emphasized caution amid current market dynamics.

TL;DR Sygnum Bank will launch MultiSYG in the first half of 2026, a fiat-backed loan secured by Bitcoin with multi-signature custody. The product allows shared control of collateral through a 3-of-5 key scheme, preventing the assets from being rehypothecated.

A cryptocurrency analyst has pointed out how a rebound could be about to begin for XRP after the Tom Demark (TD) Sequential flashed a buy signal. TD Sequential Has Given A Buy Signal For XRP In a new post on X, analyst Ali Martinez has talked about a TD Sequential signal that has appeared on XRP's 4-hour price chart.

Gold advocate Peter Schiff challenges Binance's CZ to a debate on Bitcoin vs tokenized gold, exploring which better fulfills the roles of money.

Arkham reports that SpaceX moved $134 million worth of Bitcoin to new wallets, signaling possible reorganization of its crypto assets.

On Polymarket, bettors tracking pardon outcomes have moved odds for SBF from 6% to 12.5% within a day before settling near 9.7%. The shifts have come as he has appealed his 2023 conviction and a November 3 New York court date has neared.

Bitcoin steadies near $109K following Trump's pardon of Binance's CZ, while the EU imposes sanctions on Russian crypto exchanges, impacting market sentiment.

SpaceX-linked wallets transferred $133.4 million in Bitcoin on October 24, triggering a brief market dip to $109,938 before recovery to $110,500.

Ripple acquires Hidden Road, launching Ripple Prime to expand services.

Publicly traded video sharing and livestream platform Rumble is adding Bitcoin tipping for its creator base.

XRP price rose by over 3% today, Oct. 24, as the crypto market rebounded, following encouraging Ripple ETF and options news. Ripple (XRP) token jumped to $2.4655, up by 80% from its lowest level this month.

Dogecoin treasury company Bit Origin has highlighted how Michael Saylor's Strategy has set the tone for their plans to accumulate DOGE. This came as the company is the first DOGE treasury company to be listed on the Nasdaq.

Tether, the El Salvador-based issuer of the largest stablecoin by market capitalization, is looking to post a massive $15 billion in profit this year.

Investors who are interested in ether should closely monitor the digital currency's “institutional integration," said analyst Zach Friedman.

Ripple finalizes its Hidden Road acquisition, forming Ripple Prime to deliver multi-asset brokerage services.

Ripple's XRP has seen a notable upswing, currently priced at approximately $2.45, which marks a 7% increase over the past week according to CoinGecko. This upward trend has sparked interest among analysts who draw parallels to the asset's performance in 2017, a period that led to a significant bull market.

Gala Games introduces the VEXI Retro Radiowaves, a nostalgic collection inspired by the vibrant 80s and 90s, featuring Workforce and Mini Packs for digital enthusiasts.

TL;DR Pump.fun acquired the multichain trading terminal Padre to strengthen token liquidity and expand the operational capacity of its ecosystem. The memecoin market has lost over 21% of its value in the past 30 days. The PUMP token rose more than 13% after the announcement, reaching $0.

Sygnum Bank introduces Bitcoin-backed loans with multisignature custody, allowing clients to retain control of their collateral.

Analyst CrypFlow says Bitcoin dominance could soon drop, triggering the next major altcoin rally.

BlackRock's BUIDL fund executes a $500 million deposit on Polygon.

REX-Osprey XRP ETF hits $100M, CME launches XRP options, marking a new phase in institutional crypto adoption.

Ethereum needs a 30% pump while gold requires 20% to reach $5K. But predicting which crosses the finish line first isn't as easy as that.

Arch aims to make Bitcoin the settlement layer for tokenized real-world assets and onchain finance

BNB Price Prediction has analyzed a bullish structure as BNB has broken above the 2022 pattern, amid BNB Chain growth to 2.5M DAU, $67B DEX volume, and new integrations like Axiom and Polymarket. It maps levels at $1,164, $1,336, $1,592, with support near $1,000 and risk of a $900 retest. short term

ENDRA Life Sciences has initiated a crypto treasury strategy, investing $3 million in HYPE tokens following a $4.9 million private placement led by institutional and crypto investors.

The new product is expected to launch in the first half of 2026 and will let clients borrow fiat against Bitcoin held in multisignature wallets.

The REX Osprey XRP ETF reached a major milestone today, surpassing $100 million in assets under management (AUM), signaling strong investor interest, according to REX Shares' official X account. The milestone underscores the growing adoption of crypto-linked financial products, allowing investors to gain exposure to XRP without holding the cryptocurrency directly.

Ripple unveils Ripple Prime, following the completion of its $1.25B acquisition of Hidden Road, enhancing institutional crypto services.

Hyperliquid Strategies, a digital asset treasury company, has officially filed an S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) to raise $1 billion. The fundraising effort aims to support the company's general purposes, including the strategic acquisition and accumulation of Hyperliquid's native token, HYPE.

Bitcoin stays above $110,000 as inflation hits a 9-month high but remains below market expectations. Cryptocurrency Ticker Price Bitcoin (CRYPTO: BTC) $110,643.22 Ethereum (CRYPTO: ETH) $3,915.14 Solana (CRYPTO: SOL) $191.63 XRP (CRYPTO: XRP) $2.48 Dogecoin (CRYPTO: DOGE) $0.1957 Shiba Inu (CRYPTO: SHIB) $0.00001013 Notable Statistics: Coinglass data shows 104,281 traders were liquidated in the past 24 hours for $224.32 million.

Polymarket has confirmed a token, while an airdrop has been referenced as a post-U.S. launch priority. The platform has reported over 95% share, weekly volumes above $700M, and new backing, as analysts have outlined likely governance and fee roles.

TL;DR PayPal USD (PYUSD) has reached sixth place among stablecoins, with $2.761 billion in circulation in a $308 billion market. Issued by Paxos and backed by U.S. dollars, the token grew by $1.761 billion in 77 days and is distributed across Ethereum (56.8%) and Solana (39.3%). The top 100 wallets hold 99.