Institutional traders now drive 80% of Bitget's volume: Report

Bitget's liquidity gains mirror an industrywide shift as exchanges such as Binance, OKX and Crypto.com compete to attract professional and institutional traders.

Bitget's liquidity gains mirror an industrywide shift as exchanges such as Binance, OKX and Crypto.com compete to attract professional and institutional traders.

Ferrari is making a pit stop in crypto, but only for its VIP clientele. The Italian automaker plans to issue a “Token Ferrari 499P” that its 100 most exclusive customers can use to bid on a Le Mans-winning race car.

In Q3 2025, XRP outpaced Bitcoin, Ethereum, and Solana in market value growth, highlighting its rising dominance.

Pi is back on a bullish path as blue-chip altcoins brace themselves for the ISO 2022 messaging standard activation.

Solana price analysis by Coinidol.com.

The U.S. Securities and Exchange Commission now has over 90 filings to consider as fund managers push for altcoin products.

Ondo Finance launched 100 stocks and ETF on BNB Chain, partnering with PancakeSwap for immediate listings and direct access to global traders.

The cryptocurrency briefly fell below $110K even after the U.S. Federal Reserve lowered its policy rate for the second time this year.

TL;DR The Official Trump token rose 19% in 24 hours and is trading at $8.21, leading gains in the crypto market. The surge is driven by several factors: whale buying, reduced exchange supply, and expectations of ETFs linked to the President.

Over 150,000 traders have been wrecked in the past day.

TL;DR Bitwise predicts an XRP ETF will reach one billion dollars in its first few months. Success would be based on demand from the “XRP Army” and not on the opinion of crypto experts. There are currently about 20 XRP ETF filings pending SEC approval.

In a letter sent to the SEC and Department of Labor, the senators warned that the Trump admin's push to expose the $31 trillion retirement savings industry to crypto could end in disaster.

A confirmed double-bottom puts the $3 psychological level squarely in traders' sights.

A Chinese blockchain event was reportedly cut short on Tuesday due to overcrowding, but some attendees expressed concerns over the country's recent crackdowns.

In the fast-paced world of cryptocurrency, Arbitrum has made headlines by surpassing Ethereum in terms of inflows, marking a significant milestone. On October 25, 2025, data revealed that Arbitrum's inflows exceeded those of Ethereum, showcasing its growing popularity among investors and developers alike.

Evernorth has emerged as the latest powerhouse in institutional crypto accumulation, closing in on its ambitious XRP treasury goal. In just a few days, the firm has reached 95% of its accumulation target, marking a major milestone in XRP's journey toward broader institutional adoption.

Pi sees bullish momentum amid positive ecosystem developments.

Bitcoin has been moving within a narrow consolidation range over the past 48 hours after briefly testing highs above $115,000. Despite holding its ground above $113,000, bears could argue that momentum has started to wane, with the price showing signs of exhaustion.

The Federal Reserve delivered a 25-basis-point rate cut to 3.75%-4% and announced an end to quantitative tightening on December 1, sparking immediate crypto market volatility before Bitcoin stabilized above $112,000 with analysts eyeing near-term correction risks.

Bitcoin (BTC) is set to follow the bullish trend of U.S. stocks, with the S & P 500 and Nasdaq reaching all-time highs, according to CoinMarketCap.

Thai police have arrested the perpetrator of the September 14 Yala hack, which resulted in the unauthorized withdrawal of funds from user accounts. Victims of the Yala hack have reportedly received justice on both fronts, with Thai police apprehending the suspect and also recovering the stolen funds.

Bitcoin BTC$113,421.04 is down but not out following Federal Reserve Chairman Jerome Powell's latest hawkish remarks, which challenged expectations around a December rate cut.

TL;DR Bitwise launched its Solana Staking ETF (BSOL) on the New York Stock Exchange with $56 million in debut trading volume and a total issuance of $222 million. Matt Hougan, Bitwise's CIO, said BSOL combines the traditional advantages of an ETF with automatic staking yield generation. Hougan noted that the new U.S.

TL;DR The Fed reduces rates by 25 basis points (to 3.75%-4.00%), the first cut since 2023. The central bank also announced the end of “Quantitative Tightening” (QT) by December 1. Bitcoin reacted cautiously, trading just above $111,160. The U.S.

Ondo Finance brings its tokenized stock trading platform to BNB Chain, offering over 100 U.S. equities and ETFs to global investors after reaching $350 million TVL on Ethereum.

A Beijing court has sentenced five individuals for laundering $166 million using USDT, marking a significant crackdown on crypto-related financial crimes in China.

Solana Company reports a 1M increase in $SOL holdings to 2.3M and a 7.03% staking yield, outperforming validator benchmarks in October. Solana Company updates $SOL holdings with 1M token increase.

Bitcoin dropped to $111,000, dragging the crypto market down 2.4% after the Federal Reserve's 0.25% rate cut announcement. Cryptocurrency Ticker Price Bitcoin (CRYPTO: BTC) $110,876.85 Ethereum (CRYPTO: ETH) $3,920.94 Solana (CRYPTO: SOL) $194.33 XRP (CRYPTO: XRP) $2.61 Dogecoin (CRYPTO: DOGE) $0.1931 Shiba Inu (CRYPTO: SHIB) $0.00001023 Notable Statistics: Coinglass data shows 146,874 traders were liquidated in the past 24 hours for $555.80 million.

The Argentine congressional commission investigating President Javier Milei revealed evidence showing that two months before the LIBRA scandal, Milei had already participated in a nearly identical scheme.

Dogecoin (CRYPTO: DOGE) and Shiba Inu (CRYPTO: SHIB) are flashing bearish continuation setups as both meme tokens lose grip on critical Fibonacci levels, leaving traders vulnerable to a deeper pullback. Why $0.17 Could Be The Next Stop For DOGE Traders DOGE Price Analysis (Source: TradingView) Dogecoin trades near $0.195, sitting directly at the neckline of its symmetrical triangle structure with downside pressure building.

Solana Company said Wednesday that its solana ( SOL) holdings have increased to more than 2.3 million tokens, marking an addition of roughly 1 million SOL since early October. The firm also reported an average gross staking yield of 7.

Hyperliquid price traded around $47 on October 29, but with 21Shares filing for a spot exchange-traded fund tracking the HYPE token, fresh gains are likely to propel it above the crucial $50 mark.

OKX is set to launch USDT-margined perpetual futures for ENSO and OL, enhancing crypto trading options with leverage up to 50x. Trading opens on October 29, 2025.

XRP continues to hold the psychological price of $2.60 as retail fear, uncertainty & doubt (FUD) ignites smart money accumulation.

The crypto market is witnessing heightened volatility ahead of the upcoming FOMC decision, with Bitcoin consolidating near local highs and Ethereum trading at a steep discount. While BTC continues to dominate short-term momentum, Ethereum has quietly strengthened its fundamentals.

The Bitcoin price today dropped suddenly below $110,000, falling by over 4% in a single day. The sharp move came right after the Federal Reserve announced a 25 basis point rate cut, lowering interest rates to the 3.75%–4% range while keeping its strict 2% inflation target intact.

The Bitcoin market landscape continues to evolve rapidly, with new developments emerging overnight that are reshaping short-term sentiment and long-term investor positioning across spot and derivatives markets. Price action remains steady, while on-chain and institutional signals are shifting.

Despite record activity, Arbitrum's token stalls

In October 2025, TRON's network celebrated a remarkable milestone by surpassing 6.23 million new addresses. Despite this impressive growth in active addresses, the price of TRX, TRON's native cryptocurrency, remains trapped below the $0.32 mark, facing persistent resistance.

Bitcoin price fell to $109,200 despite the Federal Reserve confirming a 0.25% interest rate cut and the end of quantitative easing. Traders expect future rate cuts, so why is BTC falling?

Pi (PI) surged over 7% in the past 24 hours on news of its ISO 20022 integration, signaling potential to compete with Ripple (XRP) and Stellar (XLM). With strong community support and low liquidity driving volatility, PI could test $0.30–$0.36 in the near term, though downside risks remain if resistance

Bitcoin (CRYPTO: BTC), and Ethereum (CRYPTO: ETH) traders continue to outperform altcoin holders as traders voice their frustration over the notable underperformance of the latter. What Happened: Data from Lookonchain shows how volatile conditions have made active trading a losing game for most.

A solid down day in crypto is morphing into a plunge after Federal Reserve Chairman's unexpectedly hawkish remarks at his post-policy meeting press conference.

Solana (SOL) is once again testing a key resistance zone, with analysts watching closely as the popular blockchain token edges toward the $210 level. According to crypto analyst Ali Martinez, Solana's price action has been forming a Parallel Channel pattern that could determine the token's next major move — a bullish breakout or a sharp rejection.

TL;DR Charles Hoskinson of Cardano defended Bitcoin from criticism by gold maximalist Peter Schiff. Hoskinson cited a history of Schiff's failed predictions on Bitcoin's price. The debate underscores the ongoing tension between proponents of traditional finance and cryptocurrencies.

Brazilian solar company Thopen is considering Bitcoin mining to utilize its extra power.

The Solana ETF issued by Bitwise is already off to a good start after news of its launch garnered attention across the crypto space yesterday. The investment product tied to the leading altcoin has not only gained hype but has already begun to record massive inflows a few hours after launch.

TL;DR Jupiter launched Limit Order V2 on Solana, a limit order system that brings enhanced transaction privacy. The update allows traders to set prices in USD or by market capitalization and fixes misexecuted orders from the previous version. It also includes a One-Cancels-Other feature, combining stop loss and take profit in a single position.

The crypto markets are bracing for major volatility as $17B Bitcoin, Ethereum options are set to expire on Friday. Crypto markets are bracing for a major volatility-inducing event.

After weeks of strong momentum, Arcblock cryptocurrency (ABT) has seen a sharp pullback, losing nearly 9% in the past 24 hours. Notably, the decline comes just days after ABT surged to a two-month high, fueled by renewed investor excitement around its AI-driven initiatives.

For years, Solana was seen as crypto's fast but fragile alternative to Ethereum, which was admired for its speed but dismissed as untested. However, that perception shifted dramatically this week.

Fed cuts rates by 25 bps to 3.754% and confirms QT will end by December, sending Bitcoin lower as traders price in more easing. Fed cuts rates by 25 basis points, signals end of QT by December as Bitcoin steadies near $111K.

This week, Tether—the world's heavyweight in stablecoin issuance—rolled out its latest attestation report for XAUT, the company's gold-backed digital token. The glittering takeaway? XAUT's total market cap just struck $2 billion, claiming nearly 54% of the $3.71 billion tied up in gold-pegged assets. Tether's XAUT Hits $2 Billion as Gold Token Market Shines at $3.

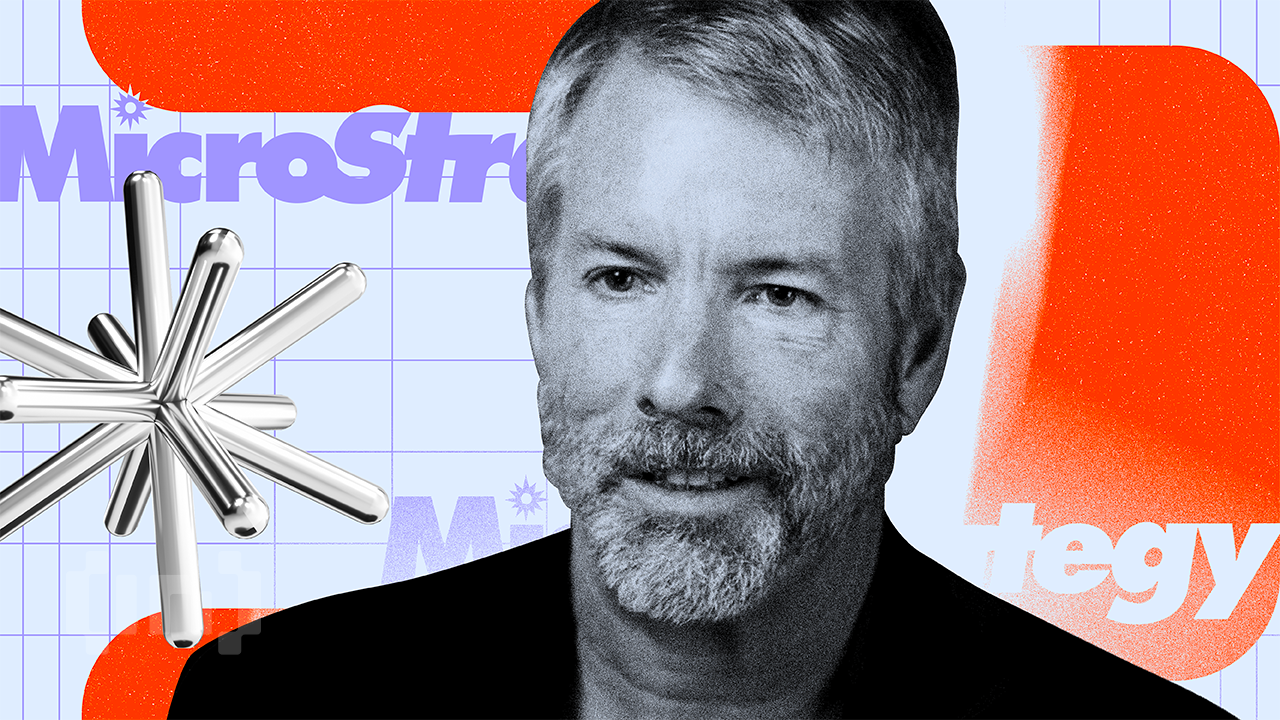

Positive regulatory developments in the US over the last 12 months are a good sign for the digital asset industry and markets, the Strategy co-founder said.

Telegram will become the first major client for its own Cocoon network. This move pledges the platform's immense user base and query volume to bootstrap a new economy for private AI inference on the TON blockchain.

Hive (HIVE) is a cryptocurrency and blockchain-based social media platform that aims to provide a decentralized and censorship-resistant alternative to traditional social media networks.

Solana ecosystem sees fresh token sale as HumidiFi readies WET via Jupiter's ICO system

The XRP community is on fire after Ripple's Chief Technology Officer, David “JoelKatz” Schwartz, announced a major new role that could mark a turning point for XRP's market trajectory.

No surprises today as the US Federal Reserve announces the second consecutive rate cut of 25 basis points.

Recent jobs data and other economic indicators have pointed to a slowing economy.

TL;DR Solana Company increased its SOL holdings to over 2.3 million tokens and achieved an annual yield of 7.03%. The company added one million tokens since early October and holds more than $15 million in cash and stablecoins.

TL;DR A key report defines BNB as the “trading engine” for the Web3 economy, distinct from BTC and ETH. BNB Chain leads the market in DEX volume, active users, and stablecoin wallets. “CZ's” pardon and new products (ETF/DAT) in the U.S. are seen as structural catalysts for adoption.

Binance Wallet now features Bubblemaps technology, enabling real-time token analysis to identify insider trading patterns and suspicious clustering activity.

$2.70 becomes the key battleground! Will XRP bulls defend or retreat?

Crypto analyst Ali Martinez has cautioned that XRP may be approaching another downswing after the Tom DeMark (TD) Sequential flashed a fresh sell signal on the daily timeframe. In a new video and transcript shared alongside a TradingView chart of the Binance XRP/USDT perpetual contract, Martinez said, “XRP could be bound for a correction.

Crypto reporter Eleanor Terrett shared that two new altcoin exchange-traded funds (ETFs) are about to start trading on the NASDAQ, beating out Dogecoin and XRP spot ETFs. According to the journalist, everything needed to begin trading is already in place, even though the government is in a shutdown.

Solana (SOL) enters November with strong bullish momentum, setting the stage for a potential breakout rally. The altcoin is benefiting from a series of positive developments recorded throughout October.

XRP price rally stalled at the 50-day moving average as traders waited for the October Federal Reserve interest rate decision and the Donald Trump and Xi Jinping meeting. Ripple (XRP) token was trading at $2.

The Alternative for Germany (AfD) party, a prominent opposition group in the Bundestag, recently submitted a parliamentary motion, urging the government to recognize Bitcoin as a “strategic asset” and not include it in the EU's Markets in Crypto-Assets (MiCA) regulation.

TL;DR European dealer SwissBullion accepts Ethereum and XRP for purchasing precious metals. Ethereum offers liquidity for fast transactions when purchasing gold or silver. XRP allows direct access to metals for international customers. A European dealer in precious metals now accepts XRP and ETH for payment. The company, SwissBullion.eu, sells gold, silver, platinum, and palladium.

Dogecoin is struggling to maintain the $0.20 psychological support as selling pressure from large investors intensifies and futures traders unwind leveraged positions. Despite briefly climbing above $0.21 earlier this week, the popular cryptocurrency has since dropped over 2%, signaling a loss of momentum and growing bearish sentiment.

The following article is adapted from The Block's newsletter, The Daily, which comes out on weekday afternoons.

Hoskinson contended that Schiff has continually failed in his price predictions for the bellwether cryptocurrency.

TL;DR Michael Saylor states that Bitcoin is firmly established as “digital gold” and that its price will continue rising due to institutional adoption and BTC ETFs. BTC functions as digital capital for new credit instruments. Banks such as JPMorgan, Citibank, and Wells Fargo accept BTC and ETH as collateral.

Telegram CEO Pavel Durov launched Cocoon, a privacy-first decentralized AI network on TON blockchain at Blockchain Life 2025 in Dubai, with AlphaTON Capital committing substantial GPU infrastructure investment.

Bitcoin's loudest bull is back on CNBC — and this time, he's putting some massive numbers on the board.

The Official Trump (TRUMP) token has staged a dramatic comeback this week, rising more than 39% in seven days to trade around $8.09. The surge comes amid renewed investor enthusiasm tied to political headlines, bullish corporate disclosures, and strong technical momentum.

TL;DR Binance Wallet has partnered with Bubblemaps, integrating its blockchain visualization tools to enhance transparency for Web3 users. The integration allows traders to monitor token distribution and wallet clusters, helping detect possible insider trading or coordinated market behavior.

World Liberty Financial (WLFI) has appointed Mack McCain as its new General Counsel. This marks another step in the company's growing push toward global regulatory readiness.

Bitcoin dips below $113,000 as markets brace for the Federal Reserve's potential rate cut. Traders are cautious amid a busy week for tech earnings and economic signals.

A Solana whale who received 222,000 SOL from the project five years ago has moved $40 million worth of tokens to Coinbase Prime.

XRP continues to wake up from slumber as whales scoop up over $560 million worth of XRP in a massive weekly accumulation spree.

21Shares files S-1 with the U.S. SEC to introduce an ETF tracking Hyperliquid (HYPE) token performance.

Ethereum has overtaken Bitcoin in institutional treasuries, signaling a notable change in digital asset accumulation trends. The latest data shows Ethereum leading with 4.1% of its total supply held by institutions, compared to Bitcoin's 3.6% and Solana's 2.7%.

According to data provided by analytics platform CoinGlass, CME is already dominating XRP futures trading, accounting for 32% of all volume with $1.47 billion.

Strategy (NASDAQ:MSTR) Chairman Michael Saylor celebrated a landmark moment as his firm became the first Bitcoin (CRYPTO: BTC)-focused company to receive an S&P credit rating, marking a new chapter for institutional Bitcoin adoption. What Happened: S&P assigned Strategy a B- rating, recognizing the firm's evolution from a Bitcoin treasury to a Bitcoin-backed credit issuer.

The bipartisan GUARD Act would criminalize exploitative AI interactions with children and require companies to disclose when users are speaking to a machine.

Jupiter Exchange unveiled Limit Order V2 on October 29, introducing privacy-protected trading with anti-front-running mechanisms and enhanced order management capabilities for Solana traders.

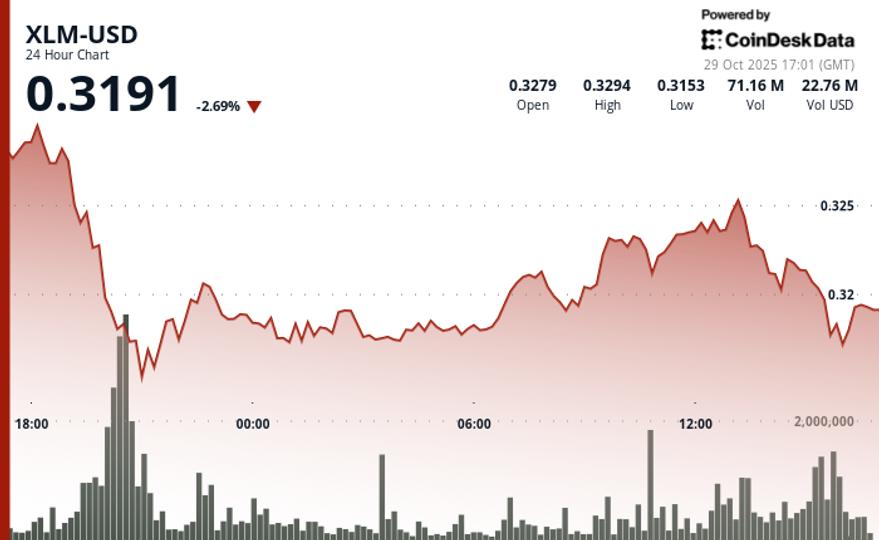

Stellar Lumens (XLM) gained 1.53% in the past 24 hours, rising from $0.3168 to $0.3177 as trading volume jumped 134% above its 30-day average. The controlled price action amid high volume points to institutional accumulation rather than retail-driven momentum.

XRP has been catching its breath lately. While everyone is piling into meme and AI coins, some traders think it's only a matter of time before liquidity swings back to big caps like XRP.

US-traded spot Ethereum exchange-traded funds (ETFs) recorded persistent outflows during late September and mid-October, periods that coincided with relative weakness in the ETH/BTC ratio. Yet, non-US inflows and continued staking growth blunted the price impact, suggesting the headwind is episodic rather than structural.

The Ethereum Foundation announced the creation of an institutional portal, aiming to onboard businesses and financial companies with promises of security, privacy, and scalability.

Ripple Chief Technology Officer David Schwartz has confirmed that the company holds the legal right to sell or transfer future claims to XRP currently locked in escrow. This means Ripple can pre-sell the rights to tokens that will be released over time — without altering the long-standing time-lock mechanism first introduced in 2017.

XRP locked escrow tokens have long been perceived as untouchable, yet recent statements from Ripple CTO David Schwartz have stirred debate about what “locked” truly means. Questions around whether Ripple could sell or transfer these tokens have spread across the crypto community, sparking further discussions about market supply, institutional strategies, and potential market impact.

Bitcoin's leading corporate and retail advocates — MicroStrategy's Michael Saylor and ‘Rich Dad Poor Dad' author Robert Kiyosaki — both predicted that the world's largest cryptocurrency could double in price by the end of 2025.

Crypto analyst Adez has revealed what most traders are missing following the Bitcoin price rally to $116,000 earlier this week. The analyst suggested there is no reason to be bullish right now, as BTC is likely to decline further before breaking out to the upside.

Bitcoin swing traders took profits, and bears opened fresh shorts after BTC failed to recapture levels above $118,000. Will today's FOMC presser kickstart a trend reversal in BTC and altcoins?

The BNB Chain sector is back in top form this week, adding over $6.4 billion to its market capitalization and gaining 2.5% week-over-week (WoW).

Bitcoin Magazine MSTR's Michael Saylor Predicts Bitcoin Will Hit $150,000 by Year-End, Expects $1 Million Within 8 Years At Money 20/20, Michael Saylor expressed bullish Bitcoin predictions — $150,000 by the end of 2025 and up to $1 million in four to eight years — citing industry shifts and new investment products as catalysts for institutional adoption. MSTR's Michael Saylor Predicts Bitcoin Will Hit $150,000 by Year-End, Expects $1 Million Within 8 Years Micah Zimmerman.

Bitcoin's bullish momentum paused on Monday as the cryptocurrency faced heavy resistance near the $114,000–$115,000 range. After briefly spiking above $116,000, sellers re-entered the market, capping upside potential and triggering a short-term pullback.