Bitwise's Solana Staking ETF (BSOL) Arrives on NYSE This Week

Bitwise's BSOL ETF debuts on the NYSE, marking a milestone in Solana ETFs and offering 100% direct exposure to Solana's spot price.

Bitwise's BSOL ETF debuts on the NYSE, marking a milestone in Solana ETFs and offering 100% direct exposure to Solana's spot price.

American Bitcoin hat 1.414 neue BTC im Wert von 163 Millionen Dollar gekauft. Das Unternehmen mit Verbindung zu den Trump-Brüdern setzt auf langfristiges Wachstum.

A newly discovered MetaMask domain has intensified speculation about a possible MASK token airdrop. The subdomain, claim.metamask.io, features a login portal with no further details.

With Uptober fading and tariffs in focus, bullish crypto has examined Pi, XRP, VIRTUAL, and Snorter, outlining how analysts have viewed the dip as consolidation while markets have looked to the Fed and potential bull-run setups into 2025.

ETHZilla uses $40 million from ether sale to repurchase shares, part of a $250 million strategy to boost stock value and NAV.

ETHzilla Corporation sold roughly $40 million worth of ethereum ( ETH) from its treasury to fund ongoing stock buybacks, prompting a few reactions from retail traders who have been frustrated by the firm's recent debt raise and reverse stock split.

DeepSeek AI Predicts a potential breakout for Solana, XRP, and BNB as market sentiment stabilizes after the post-tariff sell-off. With renewed investor optimism and key catalysts ahead, the chatbot's models suggest strong upward momentum into the next quarter.

After some initial confusion, it seems confirmed that Bitwise and Canary Capital's Solana and HBAR ETFs will begin trading tomorrow. This could further open the world of altcoin ETFs.

Despite its somewhat unserious reputation, Dogecoin has generated substantial returns over the last few years. The asset's fundamental design could pose challenges.

Altcoin ETFs are landing this week, with Canary's Litecoin and Hedera funds and Bitwise and Grayscale Solana ETFs set to begin trading.

TL;DR ETHZilla sold approximately $40 million in ETH to fund a share buyback program, acquiring 600,000 shares for $12 million. CEO McAndrew Rudisill stated that the buyback aims to reduce the number of shares outstanding, increase the NAV per share, and adjust the discount relative to net asset value. Shares rose 14.

Bitcoin climbs above $115K as trade optimism, Trump-linked investments, and Ledn's $1B Bitcoin loans boost confidence. Bulls now eye a breakout toward $124K.

There's now an ETF offering exposure to Solana, and more are likely coming. Its ecosystem will benefit from the capital inflows, assuming they occur.

A drop in inflation figures, and here come the traders again. Bitcoin rejoices, ETPs swell.

The eight-hour outage occurred during the largest liquidation event in crypto history, prompting dYdX to propose community-governed reimbursements from its insurance fund.

Canary Capital ETFs that hold HBAR and LTC are slated to debut on the Nasdaq tomorrow

The Bitcoin price is positioning for a potentially explosive move that could take it well beyond its previous all-time highs. Analysts are closely watching a critical resistance level near $116,000, which may serve as the final hurdle before BTC catapults into uncharted territory above $126,000.

Crypto market vs. Wall Street: The battle for risk capital is just beginning.

Bitwise is next up to the plate as it plans to launch its ETF tracking Solana, the sixth-largest cryptocurrency by market capitalization.

Bitcoin futures hit $543 billion in October, amidst renewed traders' appetite for leverage and institutional bets on the next bull run.

Crypto ETFs tracking Litecoin, HBAR, and Solana are set to launch this week despite the ongoing U.S. government shutdown.

The much-anticipated approval of Ripple's XRP exchange-traded funds (ETFs) in the United States has been delayed again, this time due to a government shutdown. The U.S. Securities and Exchange Commission (SEC) temporarily paused reviews, affecting applications from firms such as Grayscale, Bitwise, WisdomTree, Franklin Templeton, 21Shares, CoinShares, and Canary Capital.

Bloomberg analyst Eric Balchunas says exchanges have posted listing notices for Bitwise's Solana ETF and Canary's Litecoin and Hedera funds.

American Bitcoin Corp., a bitcoin accumulation platform and majority-owned subsidiary of Hut 8 Corp., has expanded its strategic reserve by acquiring approximately 1,414 bitcoin, bringing its total holdings to about 3,865 bitcoin as of Oct. 24, 2025.

American Bitcoin Corp., a Bitcoin mining and accumulation company, recently announced it has acquired approximately 1,414 BTC as part of its strategic market purchases since September 2025. With its latest purchase, the company's total holdings have surged to 3,865 BTC, which is valued at around $445 million at current prices.

Community speculation about a MetaMask Airdrop has risen after a claim portal has been spotted and MetaMask Rewards has launched. Polymarket odds have increased, while Consensys leaders have cautioned about phishing and have said confirmation will appear in-wallet and on the main site.

TL;DR Three crypto ETFs—Solana, HBAR, and Litecoin—prepare public listings amid regulatory slowdown. SEC guidance permits S-1 filings to activate automatically after twenty-day waiting period. Canary Capital leads with Litecoin and HBAR ETF filings despite government shutdown constraints.

After months of growing uncertainty and anticipation, the debut of exchange-traded funds (ETFs) for Hedera (HBAR) and Litecoin (LTC) is set to commence tomorrow, as confirmed by Canary Capital's CEO Steven McClurg on Monday. Hedera And Litecoin ETF Launches Imminent Crypto reporter Eleanor Terret shared the news on X (formerly Twitter), revealing that the ETF launches for Litecoin and Hedera are imminent, with a statement from McClurg underscoring the excitement for the upcoming launch.

On October 27, 2025, the finance world witnessed a groundbreaking development: a major credit rating agency, S&P Global, assigned a credit rating to a Bitcoin treasury company for the first time in history. This move not only marks a significant milestone for Bitcoin's acceptance in traditional finance but also represents a broader shift in the perception of digital assets as credible components of corporate reserves.

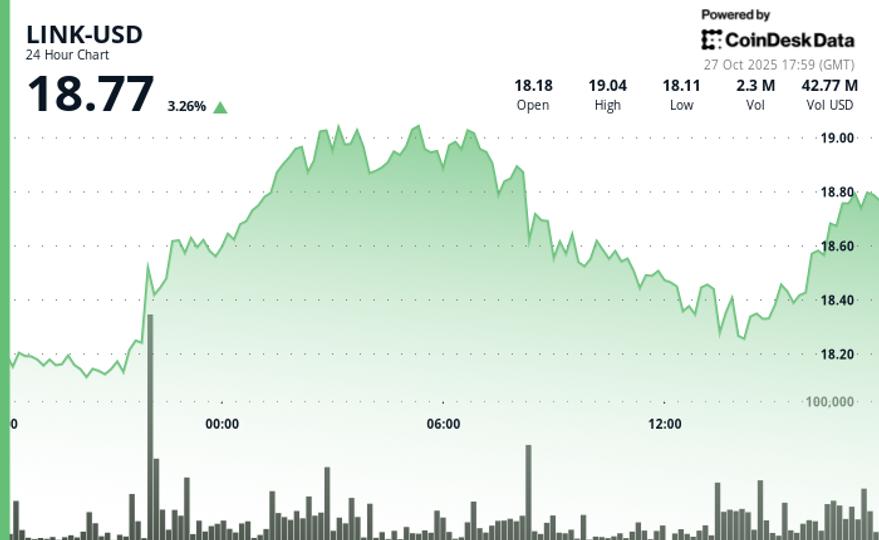

Chainlink (LINK) has remained one of the most closely watched altcoins since the October 10 market crash, as investors and analysts position for the next major market phase. Despite the broader crypto downturn, Chainlink's network strength and growing on-chain activity have kept it in focus as a potential leader of the next bullish wave.

Buterin defends Ethereum's protections, while Yakovenko warns of flaws.

Canary Capital will launch an ETF tracking Litecoin and another tracking HBAR — marking the first of their kind to go live in the U.S.

ChatGPT's XRP Analysis has detailed a $2.61–$2.74 range with XRP near $2.68, volume higher and RSI near 41, above the 20- and 200-day EMAs yet below the 50- and 100-day levels. The XRP ETF has exceeded $100M AUM, Evernorth has reached 388.7M XRP, and Brad Garlinghouse has been reported in consideration for Trump's crypto group.

ETHZilla continued climbing Monday, with the Ethereum treasury firm selling ETH to buy back shares—just like a prominent investor asked.

Ethereum (ETH) has regained its bullish footing, rebounding from $3,850 to over $4,200 in the past few sessions. The steady climb signals renewed buyer confidence and suggests that Ethereum may be gearing up for a potential breakout attempt above the crucial $4,450 resistance zone.

In a recent X post, the outspoken gold advocate and long-time Bitcoin critic argued that gold's value stems from its ancient role as a tangible store of wealth, while Bitcoin remains speculative, volatile, and devoid of intrinsic value. According to Schiff, “buying Bitcoin is essentially a bet against gold.

The maneuver highlights the pressure digital asset treasury stocks face, with many once-high-flying names now trading below the value of the crypto on their books.

Bitcoin Cash has been a big mover of late, in part due to an increasingly positive macro environment for digital assets. That said, it's becoming clear that derivatives trading activity for this network is becoming an important driver of this token's investment thesis.

XRP is staging a remarkable rebound, rising from early October lows of $1.77 to over $2.60, even as the U.S. Securities and Exchange Commission (SEC) prolongs its review of pending XRP ETF filings. Related Reading: $10K Is Coming: Arthur Hayes' Zcash ‘Vibe Check' Sparks 30% Moonshot The delays have sparked mixed market sentiment, yet XRP's trading volume and technical setup indicate growing bullish momentum.

A Madras High Court judge barred WazirX from reallocating a customer's XRP holdings and declared cryptocurrency qualifies as property under Indian law, setting a precedent that may reshape how exchanges handle user assets during insolvency proceedings across multiple jurisdictions. As The Times of India reported on Oct.

A Bitcoin miner's rare success in finding a $347,000 block raises questions about the feasibility of solo mining in 2025 amidst industrial-scale competition.

ETHZilla Chairman McAndrew Rudisill said the firm will continue to repurchase shares while ETHZ “trade at a significant discount to NAV."

Crypto market analyst Adam Livingston has sharply criticized S&P Global Ratings after the agency assigned a ‘B-' issuer credit rating to Strategy Inc. He called the assessment “hilarious” and said it reveals how deeply traditional finance misunderstands Bitcoin-based capital models. S&P Slams Bitcoin Holdings as Capital Weakness Livingston said the company has been unfairly classified

Canary Capital told Reuters that it plans to launch the first exchange-traded products in the United States tied to the litecoin and hedera cryptocurrencies on Tuesday morning.

TL;DR Cardano will integrate the x402 protocol and the Masumi network, a development Charles Hoskinson described as “very important” for its potential impact. The x402 protocol enables automated and verifiable payments through APIs without registrations or authentications. Ouroboros Leios advanced to the engineering phase, and ADA was added to the Grayscale CoinDesk Crypto 5 ETF.

Bitcoin Magazine Bitcoin Price Jumps to $115,000 As Analyst Says It May Never Fall Below $100K Again Bitcoin price surged to $115,000 today, rising over 1% in 24 hours, as optimism over easing U.S.–China trade tensions and renewed investor appetite for risk assets lifted global markets. Bitcoin Price Jumps to $115,000 As Analyst Says It May Never Fall Below $100K Again Micah Zimmerman.

This launch is notable for two key reasons: it is Asia's first spot Solana ETF and it dramatically expands the suite of virtual asset ETFs already available in Hong Kong, which includes existing spot Bitcoin and Ethereum funds, Coinidol.com reports.

The price move came hours after President Donald Trump said he expected to get a trade deal done with China soon.

TRUMP rallied by over 28% on signs of whale accumulation. The token started climbing even before the official announcement that the USD1 stablecoin would be added to the Enso chain.

Bitcoin's pace has slowed in recent weeks, but the network is far from quiet. Beneath the surface, a rare wave of activity from long-dormant wallets and a growing clash among core developers have brought fresh tension to the world's largest cryptocurrency.

Optimism over potential interest rate cuts fueled inflows of $921 million into digital asset investment products,

Solana ETF preparations are now entering final stages after the NYSE certified Bitwise's staking product for listing. The formal listing notice signals that all exchange-level requirements are now met, pending a final operational launch.

In the financial markets, a noticeable shift is occurring as Bitcoin enjoys a five-day recovery streak while Gold recedes from its recent all-time high. This divergence highlights a potential change in investor sentiment, suggesting a move away from traditional safe-haven assets towards riskier, high-return investments like cryptocurrencies.

Pump.fun traders go long as $440M Open Interest hints at a bullish gamble.

Just a few weeks after a Singaporean court approved WazirX's parent company's restructuring plan, a decision out of one of India's courts could impact users.

Prominent Danish macroeconomist Henrik Zeberg keeps warning about a major market crash.

XLM bounces back as IBM's signature security standards meet the blockchain in the Digital Asset Haven.

MegaETH's initial coin offering became oversubscribed within five minutes on October 27, attracting $360.8 million in commitments. Final allocations will be determined by assessing participants' community engagement through social and on-chain metrics.

The New York Stock Exchange posted listing notices on Monday for four spot crypto ETFs set to begin trading as early as Tuesday. This comes as the SEC is closed amid the U.S. government's ongoing shutdown.

TL;DR Hong Kong officially launched the ChinaAMC Solana ETF, becoming the third approved crypto spot ETF after Bitcoin and Ethereum. The ETF debuted on the Hong Kong Stock Exchange with a trading volume of HKD 11.39 million. The fund allows cash and in-kind subscriptions, charges a 0.

Bitwises Solana Staking ETF and new Litecoin, HBAR funds to launch this week, expanding crypto ETF access beyond Bitcoin and ETH. Crypto ETFs tied to Solana, Litecoin, and HBAR set to launch this week.

Over $2.7 trillion vanished from gold's market cap in just a week. As investors rotate risk, Bitcoin could be the next major liquidity magnet.

TL;DR 1inch partners with Innerworks to deploy AI-powered DeFi protection. AI system predicts and neutralizes cyberattacks before they occur. RedTeam simulations reveal 99% bypass rate for synthetic hacker attacks. 1inch, a decentralized exchange aggregator, announced a partnership with cybersecurity firm Innerworks to implement AI-driven protection for digital assets.

With bitcoin hovering at $115,458 on Oct. 27, prediction traders on Polymarket are making two big bets — one on how the month will close, and another on where bitcoin could stand by the end of 2025 — and the odds couldn't be more different.

Plenty of macro developments are reinvigorating demand around the world's largest cryptocurrency. However, there are other token-specific catalysts investors should be paying attention to.

Ethereum's underlying demand remains strong, but institutional investors matter a great deal. Ethereum whales have continued to add to positions as investors digest a key Layer-2 scalability ICO underway.

TL;DR Hive Digital surpassed 22 EH/s in its global Bitcoin mining capacity. The company is converting a Tier 3 data center in Sweden for its AI cloud. HIVE's short-term goal is to reach 25 EH/s before Thanksgiving. Hive Digital Technologies Ltd.

Anticipation is building ahead of Ripple Swell 2025, the company's flagship conference scheduled for November 4 to 5 in New York, with a welcome reception on November 3.

World Liberty Financial (WLFI) rose more than 6% Monday to trade near $0.1536 after Enso confirmed a partnership with USD1, the Trump-backed stablecoin now approaching a $3 billion market value. Trump-Linked Stablecoin Expands Into Cross-Chain DeFi Enso, a blockchain infrastructure provider, announced that USD1 will use its technology to deploy across multiple blockchains.

Bitcoin price is consolidating around $114,000 as miner reserves stabilize, relieving one of the main causes of sell pressure observed in recent months.

Canary Capital Group submitted paperwork to register a Litecoin ETF and HBAR ETF with Nasdaq on Oct. 27. The filings arrive amid a regulatory shift favoring cryptocurrency ETF approvals and follow the SEC's withdrawal of delay notices for multiple altcoin products.

In a historic judgment that could reshape the future of cryptocurrency regulation in India, the Madras High Court has officially declared XRP and other digital assets as property under Indian law. The decision, issued by Justice N.

Q4 exposes the gap between attention-driven narratives and propositions with traceable cash generation. EcoYield enters the market with infrastructure that combines GPU clusters for AI with renewable power generation, two vectors with structural demand and operational metrics.

American Bitcoin, a BTC miner/treasury firm launched by the Trump family, holds a little under $4.5 million in Bitcoin. The firm's stock price has climbed in recent days.

TL;DR Standard Chartered indicates that this week could define a new Bitcoin floor at $100,000 due to a confluence of political and economic factors. The forecast is based on recent trade developments between the U.S. and China. Flows from gold ETFs and potential Fed rate cuts could favor BTC.

Bitcoin is consolidating around the $115,000 level amid growing optimism over a Fed rate cut and strong institutional accumulation. Cryptocurrency Ticker Price Bitcoin (CRYPTO: BTC) $115,432.62 Ethereum (CRYPTO: ETH) $4,216.49 Solana (CRYPTO: SOL) $201.87 XRP (CRYPTO: XRP) $2.68 Dogecoin (CRYPTO: DOGE) $0.2049 Shiba Inu (CRYPTO: SHIB) $0.00001058 Notable Statistics: Coinglass data shows 125,394 traders were liquidated in the past 24 hours for $426.98 million.

The cryptocurrency topped $116K as tensions between the world's two largest economies showed signs of easing.

REX Shares' XRP ETF XRPR surpasses $100 million AUM as institutional interest in the cryptocurrency continues to grow.

As of October 2025, Pi Network has seen its value rise above $0.27, driven largely by significant investments from large-scale investors, often referred to as “whales,” and the participation of futures buyers. This recent uptick in Pi Network's price highlights a pivotal moment for the relatively young cryptocurrency, as it attracts attention from across the crypto market.

Japan has officially stepped into the regulated stablecoin era with the launch of JPYC EX, the country's first fully licensed digital yen under the revised Payment Services Act. This milestone marks a pivotal moment for Japan's financial sector, bridging traditional banking infrastructure with the Web3 ecosystem.

The $116.6k-$118k area is the next target - will the rally continue?

Bitwise crossed a key milestone toward launching the U.S. market's first Solana staking ETF, securing NYSE listing certification. However, Hong Kong moved ahead, with ChinaAMC introducing the world's first spot Solana ETF today.

XRP could surge to $3 amid strong bullish signals, including Evernorth's $1 billion accumulation and a growing supply shock at exchanges.

Explore VeChain's three-token economy, its regenerative cycle, and how it mirrors a beehive's efficiency. Learn about $VET, $VTHO, and $B3TR within the VeChain ecosystem.

Ethereum (ETH) is showing signs of renewed strength, following a brief recovery above the $4,000 level. The second-largest cryptocurrency by market capitalization has attracted renewed buying interest, signaling growing optimism among traders after weeks of consolidation.

DOGE price prediction has examined Dogecoin holding above $0.20 while the market has steadied, noting RSI near 59 and a fresh MACD turn. The analysis has outlined $0.218 resistance, $0.252–$0.27 upside, and $0.185–$0.18 downside. It has also noted MAXI DOGE's $3.80M raise.

This follows earlier SEC guidance allowing firms to go public by filing an S-1 without a delaying amendment, enabling a launch after 20 days.

BIP-444 suggests rejecting the fork could bring “legal or moral” risks, angering the community over the perceived coercive language.

With most of the altcoin ETF key dates missed out on, institutions are playing it safe on XRP.

Bitcoin (CRYPTO: BTC) is trading near $115,500 on Monday, stabilizing ahead of two pivotal macro events that could shape global liquidity and risk sentiment this week. Fed's QT Decision Could Shift Liquidity Flows Markets are positioning for Wednesday's Federal Reserve meeting, where policymakers will decide on interest rates and the balance-sheet runoff known as quantitative tightening (QT).

Bitcoin's march into mainstream finance just hit a landmark moment as a major credit agency officially rated a bitcoin treasury firm, signaling a seismic shift in how traditional markets recognize digital assets as strategic reserves.

Following October's $19.35 billion liquidation event, Bitcoin could revisit pre-crash levels targeting $121,000, according to analyst CrypNuevo's technical analysis of liquidity pools and CME gaps.

Chainlink's native token LINK advanced 3% to $18.80, outperforming the broader crypto market.

S&P Global gave Strategy (MSTR) a B- credit rating, citing high financial risk from its bitcoin-heavy business model and limited dollar liquidity.

MicroStrategy's stock (MSTR) remains under pressure as Michael Saylor continues his Bitcoin purchasing spree, impacting its market performance and causing significant valuation changes.

TL;DR A whale on Hyperliquid opened a $1.27M long position in XRP at $2.64, signaling confidence in a significant token increase. The trade indicates that the whale expects the token to hold its support and move toward higher prices. Ripple's token is approaching a decisive breakout zone; sustained momentum could push it toward $4.50–$5.00.

TL;DR Anatoly Yakovenko (Solana) stated that the belief that L2s inherit Ethereum's security is “erroneous”. He pointed out that L2s depend on complex code and “multisig” (multi-signature) systems that introduce vulnerabilities. As the L2 debate grows, Solana (SOL) is attracting institutional interest, being added by Fidelity Digital Assets.

Bitcoin Magazine Bitcoin Holds $114,530 Amid FOMC Volatility: Bulls Eye $117,600 Resistance Bitcoin closed at $114,530 last week, reclaiming $112,200 resistance but facing stiff hurdles at $117,600 and $122,000, with FOMC and tech earnings set to drive volatility on Wednesday. Bitcoin Holds $114,530 Amid FOMC Volatility: Bulls Eye $117,600 Resistance Ethan Greene - Feral Analysis and Juan Galt.

Ethereum price is showing renewed momentum as the cryptocurrency moves past key resistance levels, fueled by institutional inflows and anticipation surrounding its upcoming network upgrade. Market participants are closely watching whether these factors can push Ether toward the $5,000 mark, amid signals of accumulation and strong structural demand.

BitMine Immersion Technologies announced $14.2 billion in combined crypto and cash holdings, including 3.31 million ETH representing 2.8% of total supply, as it pursues a 5% acquisition goal.