Zcash Soars After Arthur Hayes Predicts $10K Target

Zcash skyrocketed by over 30% in 24 hours after Arthur Hayes predicted the privacy coin could one day hit $10,000.

Zcash skyrocketed by over 30% in 24 hours after Arthur Hayes predicted the privacy coin could one day hit $10,000.

Bitcoin neared $115,000 as easing US-China trade tensions lifted global risk appetite, driving gains across equities and major cryptocurrencies.

Traders eye Kaspa's $0.06 test as metrics clash with market caution.

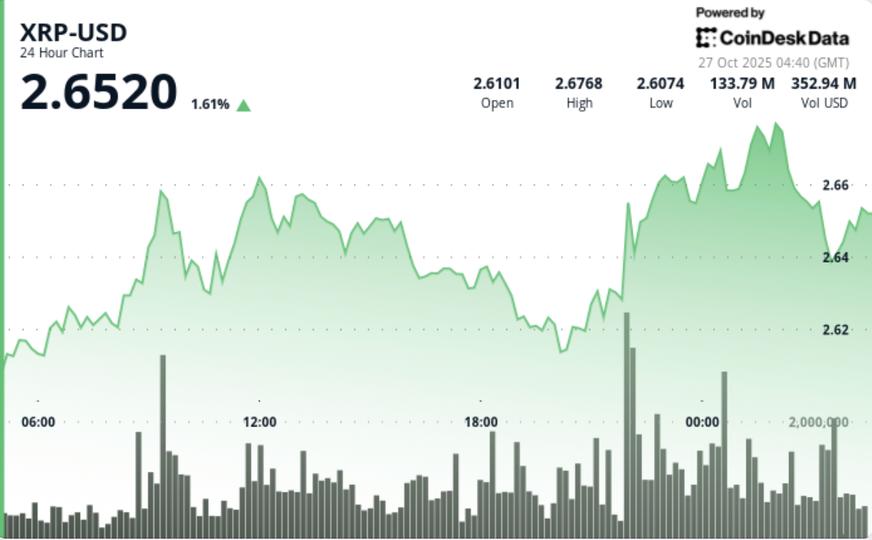

XRP price started a fresh increase above $2.45. The price is now showing positive signs and might rise further if it clears the $2.680 resistance.

DOGE outperforms broader crypto markets as volume climbs nearly 10% above weekly averages, signaling early accumulation within breakout structure.

South Korea's publicly listed Bitplanet has begun its daily Bitcoin accumulation program, purchasing 93 BTC on Oct. 26 as part of a long-term plan to build a 10,000 BTC treasury.

Disclosure & Polices: CoinDesk is an award-winning media outlet that covers the cryptocurrency industry. Its journalists abide by a strict set of editorial policies.

A new Bitcoin improvement proposal calls for a one-year soft fork for Bitcoin while developers resolve the transaction filtering debate, but the language within it has sparked controversy.

Follow up to the hour updates on what is happening in crypto today, October 27. Market movements, crypto news, and more!

Bitcoin BTC$115,229.16 has recently crossed above the 50-day simple moving average (SMA), a widely observed indicator of a short-term bullish trend. This breakout is validated by technical indicators including a fresh bullish crossover on the daily MACD histogram and a bullish cross between the 5- and 10-day SMAs, signaling growing upward momentum.

Analyst and former exchange executive Arthur Hayes stirred significant market momentum by predicting that Zcash (ZEC) could eventually reach $10,000.

Dogecoin (CRYPTO: DOGE) is surging late Sunday, on a broader market rally spurred by positive macroeconomic developments. DOGE Sees High Buying Pressure The world's most valuable meme coin spiked over 6% in the last 24 hours, with trading volume more than doubling to $1.87 billion.

JPMorgan Chase & Co.

Tether Data's AI research division, QVAC, released what it claims is the largest synthetic dataset created for artificial intelligence training under a new initiative called QVAC Genesis.

Aave Labs has acquired Stable Finance, a San Francisco-based fintech company. This acquisition will help Aave Labs develop more consumer-focused products for decentralized finance (DeFi).

Streaming platform Rumble (NASDAQ:RUM) recently unveiled a Bitcoin tipping feature that enables users to make donations directly to digital creators and online influencers in Bitcoin. The newly announced feature was introduced at the Lugano PlanB event this past Friday.

The crypto market kicked off the week with a surge in volatility, setting the stage for potential breakout moves across major digital assets. Bitcoin (BTC) price remains the center of attention as it consolidates near the $110,000 mark, hinting at a possible push toward $120,000 amid renewed investor optimism and strong inflows.

Ethereum price started a recovery wave above $4,000. ETH is moving higher but faces a couple of key hurdles near $4,220 and $4,250.

The approval of XRP exchange-traded funds (ETFs) in the U.S. has been delayed. The SEC paused reviews because of a government shutdown. This has pushed back filings from firms such as Grayscale, Bitwise, WisdomTree, Franklin Templeton, 21Shares, CoinShares, and Canary Capital. The pause is only temporary. It does not mean the ETFs were rejected.

SharpLink Gaming has made a bold move by adding approximately 19,271 Ethereum (ETH), valued at around $80.4 million, to its strategic reserve.

Bitcoin climbed over the weekend as signs of progress in U.S.–China trade talks lifted risk appetite across global markets.

Sharplink Gaming added $80m worth of Ether to its reserves, boosting its holdings to $3.6b and cementing its spot as the second-largest corporate ETH holder.

Sharplink Gaming has bolstered its Ethereum reserves by $80 million, elevating its total holdings to $3.6 billion, making it the second-largest corporate ETH holder.

Ethereum co-founder Vitalik Buterin and Solana co-founder Anatoly Yakovenko have presented conflicting views on the security of Ethereum's layer-2 networks.

Bitcoin could be set up for a big move, author Adam Livingston said, after The Kobeissi Letter noted that bank cash at the Federal Reserve fell to about $2.93 trillion.

China's state-owned defense giant Norinco in February unveiled a military vehicle capable of autonomously conducting combat-support operations at 50 kilometres per hour. It was powered by DeepSeek, the company whose artificial intelligence model is the pride of China's tech sector.

OKX announces the launch of USDT-margined perpetual futures for SynFutures (F) on October 25, 2025, enhancing trading options for users with leverage up to 50x.

Bitcoin price is attempting to recover above $113,500. BTC could rise further if there is a clear move above the $115,500 resistance.

The price of XRP is showing bullish signs of recovery as a bullish divergence continues to shape market momentum. After a week of steady buildup, XRP appears to be maintaining short-term upward pressure, hinting at a possible relief rally in the coming days.

As prices recovered on positive macro signals, nearly $350 million worth of short positions were liquidated in the past day.

In a remarkable and unusual turn of events, over 1.26 trillion Shiba Inu (SHIB) tokens, worth approximately $12.7 million at current market prices, were moved across Coinbase wallets over a two-day period. The transfers, which occurred in multiple large blocks instead of a single transaction, have left investors and analysts intrigued, sparking speculation about the nature and purpose of such massive movements.

Robert Kiyosaki is forecasting ethereum's price could skyrocket from current levels, comparing today's $4,000 range to bitcoin's early days at the same mark, and positioning ETH as a potential generational wealth-building opportunity.

South Korea's publicly listed Bitplanet has executed the first of its daily Bitcoin accumulation plan, buying the asset as part of a broader effort to build a significant war chest using the world's largest crypto.

Bitcoin doesn't consistently act as a hedge against inflation, but it has instead “evolved into a liquidity barometer,” says NYDIG's Greg Cipolaro.

XRP climbs on US-China trade deal hopes and Fed rate cut bets. ETF demand and Ripple Prime momentum drive bullish sentiment toward $3.00.

For a coin that's built its reputation on secrecy, Zcash is making a lot of noise lately. The privacy-focused cryptocurrency has quietly, and then suddenly, surged to a record market capitalization of over $5.6 billion, powered by a price rally of over 500% in roughly one month.

Leading cryptocurrencies lifted alongside stock futures Sunday as the U.S. and China reached a key trade consensus ahead of a meeting between President Donald Trump and Chinese counterpart Xi Jinping. Cryptocurrency Gains +/- Price (Recorded at 9:20 p.m.

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. For a detailed overview of U.S. markets, see CoinDesk's Crypto Daybook Americas.Bitcoin's recovery above $114,000 this week reflects a measured reset rather than a breakout.

Cardano (ADA) has long been a staple of the cryptocurrency market, known for its smart contract capabilities, peer-reviewed development, and ambitious roadmap. Currently trading at around $0.65 with a market capitalization of $23.4 billion, ADA ranks tenth in the overall crypto market.

In a surprising turn for the crypto world, a dormant Bitcoin wallet from 2011 has stirred after more than 14 years of inactivity, transferring 4,000 BTC—valued at roughly $442 million at current prices. This rare movement has captured the attention of blockchain analysts, traders, and enthusiasts alike, sparking conversations about the origins of these coins, the motivations behind such moves, and what this means for Bitcoin's on-chain activity.

Binance's CZ has secured a presidential pardon, according to The Wall Street Journal.

Bitplanet Inc. has purchased 93 BTC and initiated a daily Bitcoin buying program, positioning the company as a first mover in Korea's public-market adoption of BTC for corporate treasuries. The Seoul-based firm says the transaction was executed entirely through regulated and compliant infrastructure.

Zcash rallied 490% in the last 30 days and also crossed the $5 billion market capitalization threshold for the first time on Sunday.

XRP is rapidly ascending as the centerpiece of institutional digital finance, driving Ripple's aggressive global expansion through acquisitions, custody innovation, and liquidity breakthroughs that position XRP as the essential asset powering the future of interconnected financial infrastructure.

Ledn has funded over $10 billion in bitcoin-backed loans across more than 100 countries since the company was founded in 2018. Need Liquidity? Borrow Against Your Bitcoin and Keep Your Holdings “Never sell your bitcoin.

XRP was above the local resistance at $2.55, meaning there is reason for bulls to be cautiously optimistic.

Bitcoin traded around $114,501 at 23:35 UTC on Oct. 26, extending a clean break above $112,000 as short sellers bore most of the day's liquidations and traders parsed fresh U.S.–China trade-talk posts ahead of this week's FOMC meeting.

The Bitcoin derivatives market is showing renewed strength as total options open interest (OI) reached a record high of $63 billion, signaling growing investor confidence and heightened speculative activity. According to CoinGlass data, this milestone highlights that traders are positioning themselves for a potential major price move in the world's largest cryptocurrency, reflecting optimism about Bitcoin's near-term trajectory.

XRP's explosive mainstream breakthrough is accelerating as the REX-Osprey XRP ETF races past $100 million in assets, signaling surging institutional appetite for compliant digital asset exposure and cementing XRP's foothold in the expanding regulated crypto ecosystem.

The Federal Reserve's planned interest rate reductions could trigger a historic surge of liquidity, potentially redirecting $7.4 trillion from money market funds (MMFs) into riskier assets, including stocks and Bitcoin, by 2026. This anticipated inflow has caught the attention of investors, analysts, and institutional funds, signaling a potential transformative impact on global financial markets.

The current state of the market is certainly unusual: multiple assets are moving upward, but the lack of volatility is certainly a bad sign that could practically destroy the possibility of a proper long-term recovery. XRP is close to breaking the 200 EMA, Shiba Inu is losing volatility, and Ethereum is ready to test $4,000.

Market supply thins; whales reload. Will ETH's next move be explosive?

The price of Bitcoin (BTC) rebounded past the $112,000 resistance level over the weekend, trading at $113,724 at the time of writing, according to CryptoSlate data. Bitcoin's price breached the $113,000 mark for the second time this week—on Oct. 21, BTC was trading at $113,678.

October is traditionally one of Bitcoin's strongest months, often referred to as “Uptober” by traders, due to historical bullish trends. However, in 2025, BNB, the native token of Binance's BNB Chain, has emerged as the real standout, turning a challenging month for the broader crypto market into a period of gains for the ecosystem.

The United States and China are reportedly close to finalizing a framework agreement on key trade issues following working-level discussions that ended Sunday in Kuala Lumpur, Malaysia. The breakthrough signals a temporary easing of tensions between the two economic powers.

Ethereums largest holders are on the move again, signaling what could be the early stages of a major market shift. Recent on-chain data reveals a quiet yet powerful accumulation trend among wallets holding between 10,000 and 100,000 ETH a cohort often associated with institutional investors and high-net-worth individuals.

Traders eye Ethereum's $4K mark as leverage spikes and liquidity clusters signal a risky setup.

On October 25, 2025, a substantial transfer of bitcoin valued over $300 million ignited a wave of intrigue and speculation across the cryptocurrency community. This massive movement involved thousands of BTC being withdrawn from Kraken's hot wallet, prompting enthusiasts and market analysts to theorize about the intentions behind this quiet acquisition.

A recent solo Bitcoin miner made headlines by successfully mining an entire block, earning 3.125 BTC — approximately $347,000 at current prices. While this rare achievement highlights the potential rewards of mining, the industry as a whole is entering a complex new phase shaped by rising costs, government energy reforms, and a growing shift toward artificial intelligence.

A heated debate among macro analysts is challenging the long-standing credibility of the ISM Manufacturing Purchasing Managers Index (PMI) a key economic gauge often used to predict business cycles and Bitcoin market tops. The discussion underscores a broader clash between traditional economic indicators and modern financial-conditions-based analysis, with implications for crypto market forecasting.

Solana (SOL) continues to battle resistance at the $200 level, a key psychological and technical barrier that has repeatedly halted its recovery attempts. Despite an overall optimistic crypto market, Solanas inability to secure this threshold as support has made investors wary, prompting profit-taking and increased short-term volatility.

Pi Coins price continues to trade sideways, struggling to gain momentum after multiple failed attempts to breach resistance levels. Over the past several days, the cryptocurrency has remained stagnant, reflecting weak investor participation and indecision among traders awaiting a clear market direction.

Strategy (formerly MicroStrategy), the worlds largest corporate Bitcoin holder, has sharply reduced its pace of Bitcoin accumulation, marking its slowest buying period in years. Despite the slowdown, Executive Chairman Michael Saylor continues to hint that another significant purchase may be imminent.

In a groundbreaking judgment, the Madras High Court has officially recognized XRP and other cryptocurrencies as property under Indian law. Justice N.

Ethereums bullish momentum continues to gain traction as major institutional investors and market analysts express renewed confidence in the asset. Recent on-chain data revealed that SharpLink Gaming transferred $78.3 million worth of ETH from FalconX, signaling significant accumulation among institutional players taking advantage of the market dip.

The cryptocurrency market is experiencing a significant uplift, driven by easing tensions between the United States and China. The market's resilience suggests that the immediate nightmare of a renewed tariff war may be receding.

Permabull investor Tom Lee predicts that easing trade tensions between the US and China could spark a rally for Bitcoin (BTC), Ethereum (ETH), and US equities. His outlook follows renewed optimism after both nations showed signs of compromise in their economic standoff.

In a landmark ruling, the Madras High Court in India has declared that XRP and other cryptocurrencies as property under Indian law. The judgment was given by Justice N.

The video-streaming giant boasting 51 million monthly users is getting ready to light up December with bitcoin tipping. Rumble CEO Chris Pavlovski and Tether CEO Paolo Ardoino dropped the news at the Plan B Forum in Lugano, Switzerland—giving attendees a preview of what could soon make content creators' wallets a little wealthier.

Shiba Inu is now down 89% from its all-time high in October 2021. Attempts to spur growth within the Shiba Inu blockchain ecosystem have had little impact on price.

Sui (SUI) has recently captured renewed investor attention as it rebounds from a key demand zone, signaling potential bullish momentum for the blockchain network. The cryptocurrency has been trading within a descending channel since August, recording consistent lower highs and lows.

Ethereum price rebounds above $4,000 as traders anticipate Trump's upcoming tariff talks with China's Xi Jinping and rising short positions.

SOL has under-performed ETH by 10% since late September.

Ethereum's largest holders are stirring again, and if history is any guide, the quiet accumulation underway could foreshadow the next major market shift.

Ethereum layer-2 networks have glaring security and centralization issues, according to Anatoly Yakovenko, co-founder of the Solana blockchain.

A growing number of XRP supporters are drawing parallels between Evernorth and MicroStrategy's impact on the crypto market.

Cardano (ADA) may be on the verge of a significant breakout as a key technical pattern begins to form on its daily chart.

After weeks of market uncertainty, a growing number of analysts believe that altcoins may be approaching a critical moment.

The Australian government is working to protect its creators through stronger copyright laws. Starting tomorrow, lawmakers in the country will spend two days reviewing copyright laws to find a middle ground between creators and the AI developers who need access to their work.

JPMorgan Chase, one of the largest global banking institutions, is set to allow institutional clients to use Bitcoin (BTC) and Ether (ETH) as collateral for loans by the end of this year. This move marks a significant milestone in the integration of digital assets into traditional finance, signaling a growing recognition of cryptocurrencies as viable financial instruments.

After this month's v30 update to Bitcoin Core, some developers are considering a temporary soft fork to tamp down on arbitrary data, like inscriptions.

XRP has gained 355% in 52 weeks, vastly outperforming Bitcoin and Ethereum since the 2024 U.S. election. The global payments market is already fragmented, and XRP won't dominate it anytime soon.

Crypto investors were anticipating more gains as October approached. The month has been nicknamed “Uptober” due to its long history of significant gains for Bitcoin and the crypto market as a whole.

The XRP/BTC monthly chart has finally snapped the long diagonal that's capped XRP since 2018, and one analyst on X thinks that shift could rewrite the pecking order. Posting under the handle X Finance Bull (XFB), the analyst argued that XRP will soon start to outperform Bitcoin.

Solana's price continues to face resistance around the $200 mark, a level that has proven difficult to break. After multiple attempts at recovery, the altcoin remains constrained just below this threshold.

A dormant relic from Bitcoin's earliest days has made headlines after lying inactive for over 14 years. A Satoshi-era Bitcoin wallet, which mined 4,000 BTC between April and June 2009, moved 150 BTC this week, sparking curiosity among analysts and market watchers.

Zcash (ZEC) has skyrocketed over 500% this month, hitting $360 as traders chase momentum. But with RSI readings at record highs, analysts warn a short-term correction could precede any push toward the $400 mark.

Tom Lee, co-founder of Fundstrat Global Advisors, chairman of BitMine, and one of Wall Street's most vocal crypto optimists, has reiterated his bullish stance on Ethereum, describing the network as being in the midst of a “supercycle” despite its muted price action.

A recent estimate from Fidelity found that as much of 42% of Bitcoin's supply could be considered illiquid by 2032, if current trends hold.

The stock-to-flow model may not be the best framework to forecast Bitcoin prices, Bitwise investment analyst André Dragosch said.

Circle, the issuer behind the popular stablecoin USDC, has minted an impressive $750 million on the Solana blockchain this month, further boosting liquidity and adoption across the network. This move highlights growing confidence in Solana as a platform for decentralized finance (DeFi) and stablecoin transactions, as well as Circle's commitment to expanding the use of USDC in high-speed blockchain environments.

NYDIG's Greg Cipolaro suggests Bitcoin isn't an inflation hedge but benefits when the US dollar weakens, acting as a liquidity barometer instead.

After the biggest crypto deleveraging event in five years, Tom Lee, chairman of Bitmine Immersion Technologies, says the worst may be over.

On October 26, Ethereum hovered around $4,070 per unit, testing a crucial resistance level. The digital asset fluctuated within a daily range from $3,926 to $4,081.90, amassing a trading volume of $16.27 billion and maintaining a market cap of $489 billion.

Whale comeback vs.

Ethereum's fundamentals continue to strengthen as major investors and analysts signal renewed confidence in the asset. Institutional investors like SharpLink Gaming are moving millions in ETH.

Pi Coin's price has entered another phase of sideways movement after several attempts to break past resistance failed. Over the past few days, the cryptocurrency has remained largely stagnant, lacking strong investor participation.

Just ten days after a 2.73% difficulty dip, Bitcoin's gears are revving back up. If miners keep cranking out blocks at this pace, the next difficulty epoch could deliver a hefty climb. Roughly 81% of the 2,016 blocks have already been mined, setting the stage for the change expected on Oct. 29, 2025.

Sen. Cynthia Lummis (R-Wyo.) says that the Trump administration is considering a radical plan to convert a portion of the nation's gold reserves into Bitcoin (CRYPTO: BTC) to build a strategic digital reserve.

Strategy (formerly known as MicroStrategy), the largest corporate Bitcoin holder, is acquiring the top crypto at its slowest pace in recent memory.