Ethereum's stablecoin engine hits $6T in Q4 – Is ETH breakout next?

Record capital velocity and $180B liquidity is pushing the network into a new settlement era.

Record capital velocity and $180B liquidity is pushing the network into a new settlement era.

Bitcoin is making another attempt to break the downtrend that has kept the crypto king capped since late October. Price is hovering near $91,000 as investors watch a rare shift in market structure unfold.

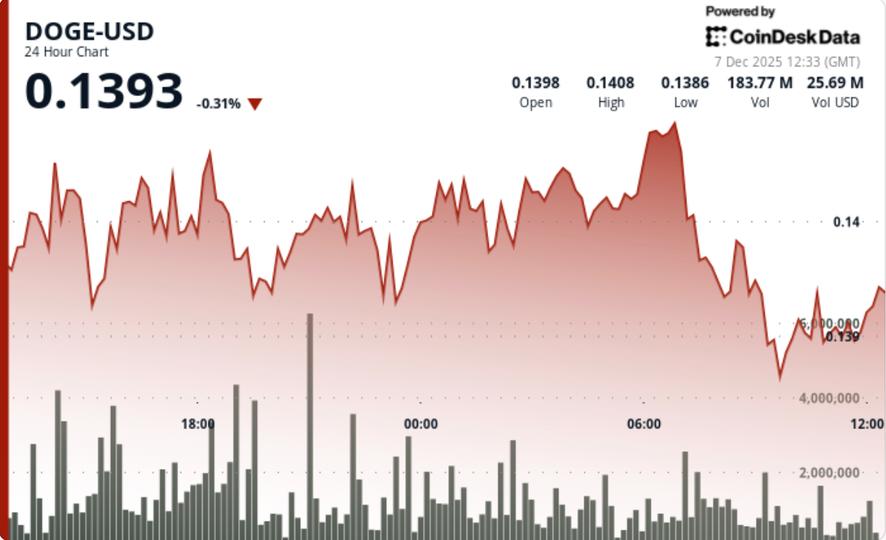

Dogecoin has lost over half its value in 2025. This meme coin has gone through similar phases before.

Traders must remain patient for a range breakout to occur on high trading volume before betting on the next direction.

Crypto volatility has returned, but has not slowed adoption by institutions

Bitcoin and XRP both fizzled out this year. Bitcoin's scarcity and growing adoption still make it a compelling investment.

Bittensor's first token halving arrives Dec. 14, cutting TAO issuance in half as the AI-focused network adopts a Bitcoin-style fixed supply model.

In early December 2025, the cryptocurrency market witnessed significant strategic maneuvers by large investors, commonly known as “whales,” who accumulated roughly 30 billion Pepe Coins. Despite this considerable buying activity, the value of Pepe Coin experienced a sharp decline, falling to $0.000004512.

Key Insights:

Privacy-focused Ethereum L2 Aztec's token sale was the first public test of the Continuous Clearing Auction mechanism developed jointly with Uniswap Labs.

Ethereum's largest holders are redirecting their focus towards Remittix, a digital currency gaining momentum due to its recent advances and security credentials. As of early December, reports indicate that these investors, often referred to as “whales,” are making strategic changes in response to Remittix's gains in the mobile wallet sphere and its top-tier security evaluation by CertiK.

When European police staged another coordinated sweep against crypto mixers this autumn, most people saw a familiar headline and scrolled on. But every seizure, every frozen server rack, every compressed hard drive pushed into an evidence van has the potential to change how Bitcoin actually moves.

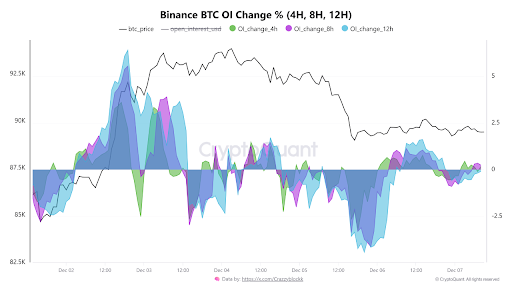

Derivatives activity cools on Binance as Bitcoin holds its key support range between 86K and 88K.

Solana steadies above key support as momentum improves and traders watch for a possible near-term recovery.

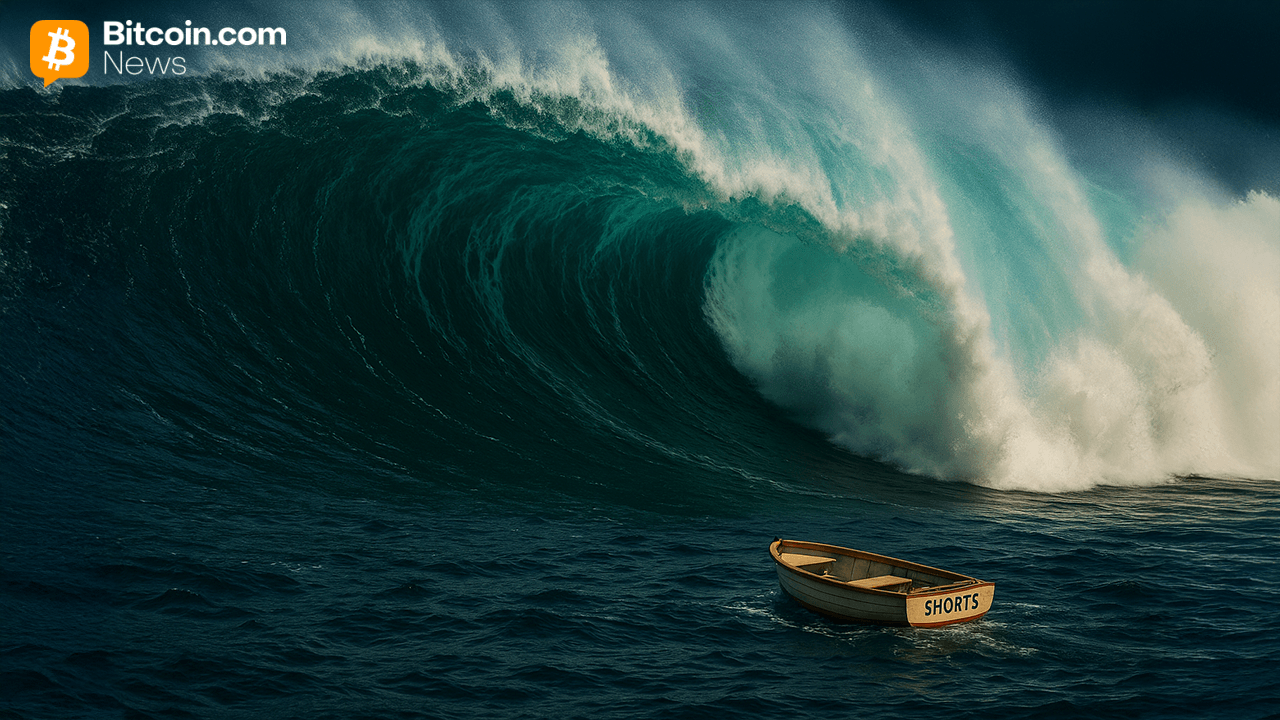

After spending the morning flirting with the dungeon below $88,000, BTC clawed its way upward and blasted to an intraday high of $91,767. Bitcoin's latest rebound didn't just flip the script on weekend traders — it triggered a full-blown liquidation bonfire across the crypto market as deep-pocketed buyers muscled shorts into oblivion.

Jupiter Lend addresses concerns over incorrect contagion risk claims.

BPCE launches in-app trading for BTC, ETH, SOL, and USDC, marking a major shift as European banks race to meet rising retail crypto demand.

As the year winds down, prediction markets suggest there is only a slim chance that XRP will hit a record high by December 31.

Bitcoin's Sunday price action turned chaotic after a wave of whale-driven sell orders triggered a rapid $2,000 drop, mass liquidations, and an equally aggressive rebound.

Ethereum is currently trading 35% below its all-time high of $4,954 from August. New regulatory changes, especially those related to staking, could create new momentum for Ethereum investment products.

Bitget launches POWERUSDT perpetual contract on December 6, 2025

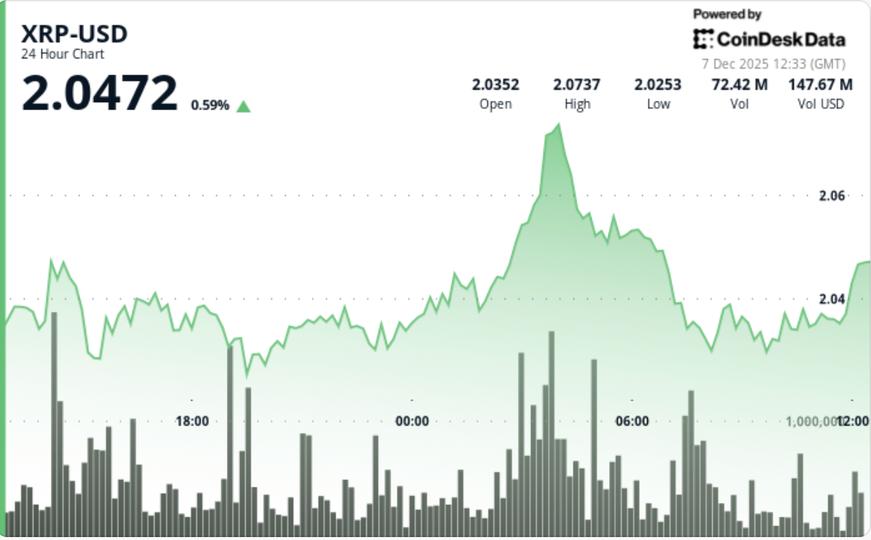

XRP is going through a rare moment of tension. While institutional investors continue to pour in via spot ETFs, social sentiment around the asset plunges sharply into extreme fear territory.

As of December 7, 2025, Ethereum has incinerated over six million ETH through transaction fees since the London upgrade on August 5, 2021, equivalent to more than $18 billion at current exchange rates. Despite this massive burn, Ethereum's overall supply continues to grow, presenting a paradox in the realm of cryptocurrency economics.

On Sunday, Bitcoin's value fell below $88,000, casting doubts on the anticipated year-end rally often referred to as the “Santa Rally.” This sudden decline has sent ripples through the derivatives market, leading traders and analysts to reassess their strategies during what is traditionally a bullish period.

This week, high-caps fell below key levels. Here's a look at how some of your favorite coins fared.

On December 7, 2025, Bitcoin's price fluctuated between $88,990 and $89,473, tantalizingly close to the coveted $90,000 threshold. As traders speculate on its future trajectory, the cryptocurrency holds a market capitalization of $1.78 trillion, coupled with a 24-hour trading volume of $21.62 billion.

Russian President Vladimir Putin asserted only a year ago that no power can ban Bitcoin (CRYPTO: BTC) regardless of what happens to the dollar. While many saw it as a message to the West on international sanctions, the country has taken targeted steps to open its economy to the world's largest cryptocurrency.

UK cements Ethereum property rights as digital assets gain legal clarity while ETH futures open interest rebuilds after October crash.

On December 6, 2025, the co-founder of Kamino, a competing lending platform, publicly challenged Jupiter's assertions regarding their “isolated vaults” and responded by disabling a migration feature. The dispute highlights increasing tensions within the decentralized finance (DeFi) sector, as platforms vie to assure users of their security and reliability.

Binance's latest Proof of Reserves reveals a major shift in user positioning, where Bitcoin balances are climbing, while ETH and USDT fall.

Jupiter's inaccurate risk claims corrected, raising transparency concerns.

Jupiter Lend clears up claims of 'zero contagion' and explains how vaults operate amid user concerns.

In a recent tweet, Ripple CTO David Schwartz indicated that his hub had been running on rippled v2.6.2 with no issues reported. This information from the Ripple CTO prompted a question from an X user who asked what the hub was for.

According to metrics, the tally of ETH burned from fees has sailed past the 6 million mark, meaning that as of Dec. 7's exchange rates, more than $18 billion in value has effectively gone up in smoke since the London hard fork on Aug. 5, 2021.

Michael Saylor has reignited market discussion after hinting at another Bitcoin buy. The signal comes as rising network pressure and growing corporate accumulation shape the current market mood.

Hyperliquid's HYPE token slid to a seven-month low as the market reacted to a steep decline in the protocol's dominance and renewed concern over recent token movements.

Bears have seized the initiative on the last day of the week, according to CoinStats.

The number didn't look dramatic at first glance ($13.5 billion in overnight repos on Dec. 1), but for anyone who watches the Federal Reserve's plumbing, it was a noticeable spike.

Bitcoin's rising liveliness metric and a fresh Russell 2000 breakout hint at resilient onchain demand and another potential bull phase.

Dogecoin has just celebrated its 12th anniversary, a milestone that arrives during a period of shaky price action. The meme coin has spent the majority of recent days trading with a bearish tone, but its anniversary places into perspective how much the crypto environment has changed since the token's joke-related launch in 2013.

WisdomTree data shows XRP as the only major crypto with sustained global institutional inflows in 2025.

The rates of most of the coins are falling today, according to CoinStats.

Ric Edelman isn't budging from the Bitcoin investment strategies he urged six months ago, even as BTC lingers far from record-breaking heights.

Dog-themed cryptocurrency Shiba Inu has seen a surge in burn rate in the last 24 hours, with the total amount burned surpassing 34 million SHIB.

Notcoin (NOT) experienced an impressive price increase of nearly 36%, driven by unexpected speculative interest in this Telegram-based token. Despite the initial excitement, the surge quickly dissipated, marking the most significant selling period in the past six months.

Bitcoin's (BTC) price structure is tightening, and one key level now stands between the market and a deeper correction, according to trading expert Michaël van de Poppe.

The last day of the week is controlled by bears, according to CoinStats.

Ansem, a high-profile crypto trader, has thrown a direct call into an already tense December market, arguing that Bitcoin's price path may curve straight back into $80,000 before 2025 is out.

Solana co-founder Anatoly Yakovenko has voiced strong opposition to Coinbase's Base network's latest expansion strategy. The controversy stems from Base's introduction of a new bidirectional bridge, which Yakovenko dismisses as misleading and detrimental to Solana's interests.

Meme coin Shiba Inu (SHIB) spent most of the week stuck in the $0.00000835-$0.00000855 range, barely moving from the lower band it's held since late November. But this stagnant market didn't stop one of the biggest outflows of the quarter, with a combined 4,136,208,073,220 SHIB leaving Coinbase in two direct transactions, as per Arkham.

Bitcoin Cash has an early year that few observers anticipated. While most L1 blockchains struggle to stand, BCH moves forward confidently, as if the entire market has finally decided to reconsider its place in the crypto landscape.

A sharp drop in sell-side activity hints that Ethereum's next decisive move may come sooner than expected.

Bitcoin saw snap downside toward the weekly close with $87,000 back on the radar ahead of an important Federal Reserve interest-rate decision.

As of early December, Hedera's HBAR token has encountered a significant 11% decline over the past week, remaining trapped within a consolidation range spanning $0.150 to $0.130. This stagnation follows a three-week period during which the token has struggled to break free and generate upward momentum.

Bitcoin stayed close to $89,000 on Sunday, holding inside a narrow trading range as the broader crypto market continued to drop. The global crypto market cap slipped to $3.01 trillion. Compared to earlier in the month, trading volumes have slowed.

Bitwise says the XRP “game has changed” as ETFs surge toward $1B AUM after the SEC lawsuit ended.

A record movement of 23 561 billion SHIB in just 24 hours shook the crypto community. Historic anomaly, technical error or manipulation?

Gold bug Peter Schiff and Binance founder Changpeng Zhao (CZ) have faced off in a widely anticipated debate over the utility of gold and Bitcoin (BTC).

Bitcoin slid under $88,000 on Sunday morning, putting the market squarely in “so much for the Santa Rally” territory. With derivatives traders scrambling for footing and open interest wobbling across major venues, bitcoin is signaling that December may be more coal than candy canes.

French banking heavyweight BPCE is set to roll out crypto trading services to its retail customers starting Monday.

As of early December 2025, Ethereum is grappling to overcome the critical $3,000 price threshold. The digital currency briefly ascended above this mark but has since retracted, highlighting ongoing uncertainty within the marketplace.

In recent days, the AI Agent token PIPPIN has seen a remarkable increase of 150%, capturing the attention of the cryptocurrency market. As of today, PIPPIN is trading at $0.263, showing an impressive increase of 42% in just one day, with an intraday spike reaching 84%.

A top investor, who claims to have purchased Bitcoin when it was trading at just $3,000 has dumped his entire Bitcoin stack to invest in XRP.

Stable Protocol launching mainnet on December 8, 2025

The U.S. president's latest national security strategy focused on AI, biotech, and quantum computing.

Notcoin price surged nearly 36 percent in the past 24 hours as sudden bullish speculation lifted the Telegram-based token sharply higher.

The long-running question about whether another cryptocurrency can truly match what Bitcoin represents has resurfaced, and Ripple's Chief Technology Officer David Schwartz has stepped forward to offer his opinion. His comments were based on an argument claiming that Bitcoin's properties could be copied by simply recreating its code.

ETF and derivatives numbers may have the answers.

As of December 2025, corporate treasuries have outpaced major cryptocurrency exchanges in the volume of Bitcoin they hold. This shift signifies a pivotal transformation in the financial landscape, showcasing how Bitcoin is increasingly being perceived as a strategic reserve asset by leading corporations worldwide.

As of December 2025, Bitcoin is experiencing a period of intense turbulence with a significant fluctuation in its value. Despite this volatility, institutional investors remain undeterred, continuing to play a crucial role in the cryptocurrency market.

Dogecoin celebrates 12 years since its creation. Founders Billy Markus and Jackson Palmer reflect on the memecoin's journey from joke to $22 billion market cap.

JASMY tests multi-year support as analyst watch for structural signals that could confirm a lasting trend shift.

OKX launches its Christmas Calendar Campaign with daily BTC rewards. Users can earn up to €150 — and new users up to €172 — by completing simple tasks.

As of December 2025, the perpetual contracts market has swelled to an impressive $1 trillion, highlighting a significant expansion in the realm of decentralized finance (DeFi). Despite this remarkable growth, the HYPE token, a key player in the space, has seen its price falter.

Charles Hoskinson's newest short post saying Monday, which is tomorrow, "is going to be a good day" was enough to generate a lot of attention from the ADA community, and it is no surprise really. The market for the Cardano token was dull recently as the price has been stuck near $0.41 for weeks without any narrative.

K33 Research says market fear is outweighing fundamentals as bitcoin nears key levels. December could offer an entry point for bold investors.

HBAR price slipped 11 percent this week as Hedera failed to break out of a consolidation range that has persisted for more than three weeks.

Open Interest trends uncover whether Bitcoin price swings come from spot demand or leveraged futures.

the cryptocurrency market has witnessed a remarkable surge in the price of Luna Classic (LUNC), which skyrocketed by over 160%. This dramatic rise comes as investors keenly await the final sentencing of Terraform Labs co-founder Do Kwon, perceiving it as a pivotal event that could provide much-needed clarity and direction for the troubled project.

The cryptocurrency PIPPIN has experienced a remarkable 59% increase in its valuation, driven by significant investment from large-scale players in the market, often referred to as ‘whales.' As of December 6, 2025, these investors have infused approximately $19 million into the currency, indicating a strong vote of confidence in PIPPIN's future potential.

Bitcoin price is rangebound today between $88,990 to $89,473 over the last hour, perched just below the psychological $90K marker as traders wrangle over its next move. With a market capitalization of $1.78 trillion and a 24-hour trading volume of $21.62 billion, the coin remains the heavyweight champ of crypto—though its footing looks increasingly cautious.

Bitcoin consolidates between 85K–90K as the market prepares for a big move. Here are 5 crypto coins with strong potential for December 2025.

ETH exchange balances fall to 2015 lows, creating a thinner supply pool that could amplify future demand shifts. Staking, L2 growth, and custody trends continue pulling ETH off exchanges, reducing immediate selling pressure.

Over the last three months, XRP's on-chain activity has increased dramatically, with a number of network metrics approaching levels that resemble a 400% surge in comparison to their late-summer baselines.

Ripple transferred 250 million XRP tokens, sparking renewed interest in the cryptocurrency market. As market dynamics shift, the potential for an XRP price increase to $2.50 has become a topic of vigorous debate among investors.

Ethereum co-founder Vitalik Buterin is promoting a new mechanism to mitigate sudden spikes in transaction costs on the network.

The SEC chair expects the entire U.S.

Yesterday, Dogecoin officially completed 12 years since its creation. Billy Markus and Jackson Palmer, the founders of DOGE, celebrated the anniversary on X.

The Bitcoin price continues its descent deep into red territory, as investors increasingly tread the capitulation path. Interestingly, a recent on-chain analysis has been carried out, which dives into the underlying factors that typically control Bitcoin's December price action.

The high weekend volatility meant that long positions were highly risky, and short-selling was rampant.

Rising bitcoin supply in loss, weakening spot demand and cautious derivatives positioning were among the issues raised by the data provider in its weekly newsletter.

DOGE network engagement surged to 71,589 active addresses — its highest reading since September — signaling improving chain activity despite muted price performance.

In early December 2025, Jupiter Lend, a key player in the decentralized finance sphere, has openly addressed its risk management strategies in light of growing anxiety surrounding Solana's DeFi ecosystem. This disclosure comes as a response to mounting concerns over the potential ripple effects within the Solana network, which has been a hotbed for decentralized finance activities due to its high-speed transactions and low fees.

XRP exchange-traded funds have gathered more than $1 billion in assets only a couple of weeks after going live, a pace that many in the market say is unusually fast for new financial products.

On December 7, 2025, MicroStrategy, a leading enterprise analytics and mobility software company, announced an ambitious move to raise $1.44 billion through a bond offering. This strategic financial maneuver aims to bolster its substantial Bitcoin holdings as part of CEO Michael Saylor's ongoing campaign to reinforce the company's commitment to cryptocurrency.

A reported 23.56 trillion SHIB token movement sparked concern, but market data reveals it's likely a tracking error.

Veteran trader projects Bitcoin upside, citing structural support and dismissing pullbacks as consolidation.

Bitget, the world's largest Universal Exchange (UEX), today announced that its US stock futures have surpassed $10 billion in cumulative trading volume.

Social sentiment for XRP has collapsed to extreme fear levels, historically preceding short-term rebounds.

Michael Burry has responded to critics who continue to cite his early-2021 bearish calls, including on Bitcoin, as evidence that his current warnings should be dismissed. According to Burry, commentators and journalists, including Bloomberg's, have repeatedly used those 2021 examples to argue that he has been "wrong again and again.